Market Snapshot: August 2022

In summary:

Equity and Bond market volatility rolls on … particularly after a hawkish Federal Reserve

-

Jerome Powell’s speech at Jackson Hole signalled US Cash rate rises will not stop until inflation is under control, so equity markets

promptly sold off.

- Most equity markets around the world ended August in negative returning territory. The exceptions being July's poor performer, Emerging Markets, and the strong dividend paying, Australian market.

- Bond yields increased throughout August after the complete opposite occurred in July. Whilst August was a poor month for bond returns, current yields (well above 3%) indicate a positive inflation-adjusted return over the next five or more years which is a pleasing reversal for bond investors compared to recent years.

- Rising cash rates are expected to further slow the global economy (including Australia’s) and the full effects are yet to be realised as it generally takes many months for results. Either way more rate rises are coming so market volatility should continue until the existence of stronger signs of persistent declining inflation.

- Cheap opportunities across investment markets continue to be few and far between, so Investment portfolios should be diversified, therefore avoiding concentrated positions. Higher quality investments, including investment grade bonds, generally perform better in a weakening economy. Regular rebalancing can be beneficial in the long run as a systematic way of buying in weakness and selling strength.

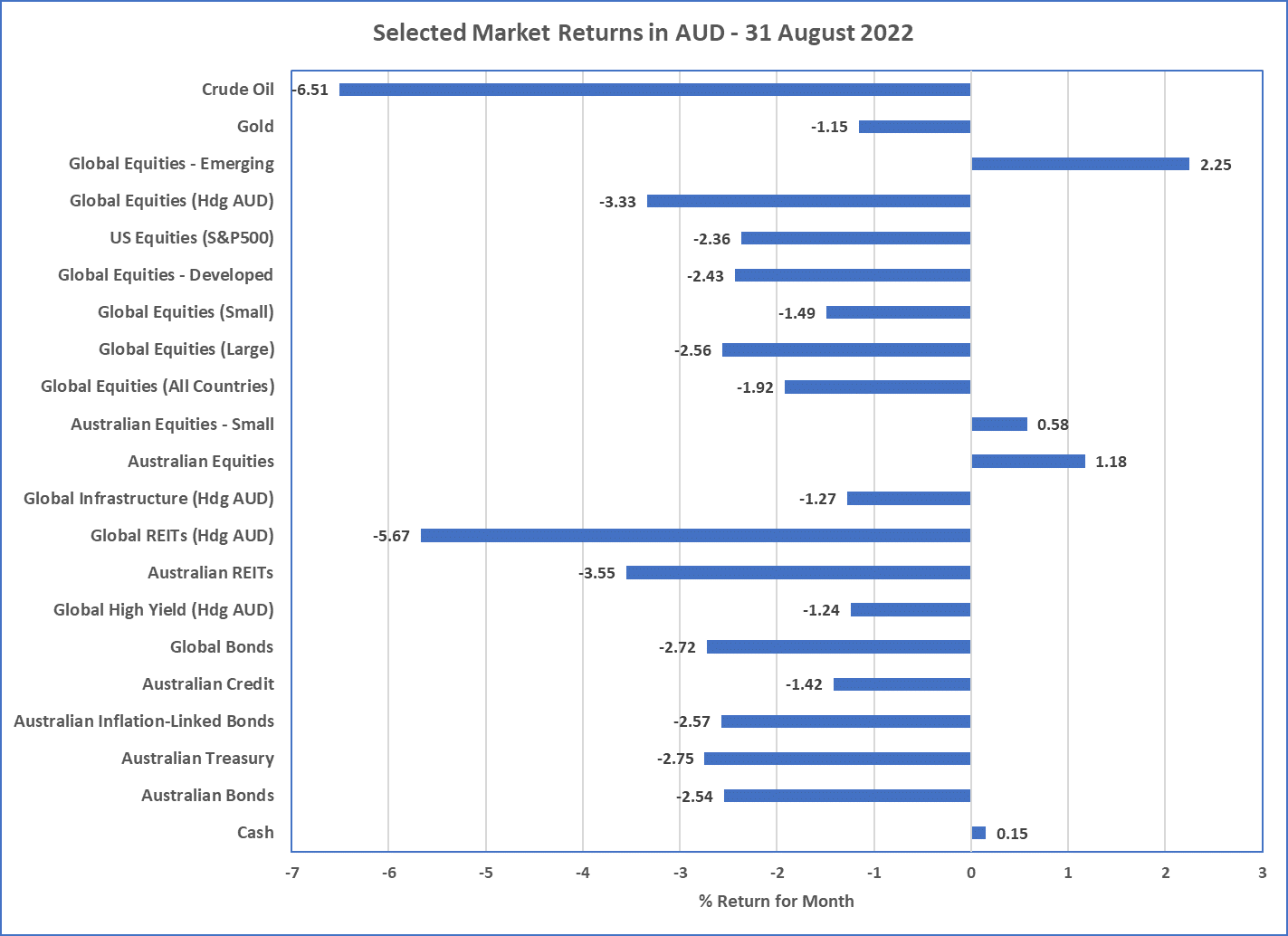

Chart 1: A late pullback pushed most markets into negative returns for August

Sources: Morningstar

What happened in August?

Markets & Economy

Late August equity market downturn due to Federal Reserve confirming higher cash rates “until job is done”

- Most equity markets around the world were having a positive August, and then on 26 August, Federal Reserve Bank Chair, Jerome Powell, made a short speech at Jackson Hole’s economic symposium saying, “our responsibility to deliver price stability is unconditional” and “we must keep at it (i.e. increasing cash rates) until the job is done (i.e. lower inflation)”. Equity markets accepted these statements (amongst others) as higher cash rates at any short-term economic cost … equity markets have been falling since then.

- As Chart 1 shows, the only equity markets that have not declined during August were Australian Equities and Emerging Markets. These equity markets are generally regarded as “Value” or cheaper markets, which have been less prone to concerns about higher interest rates.

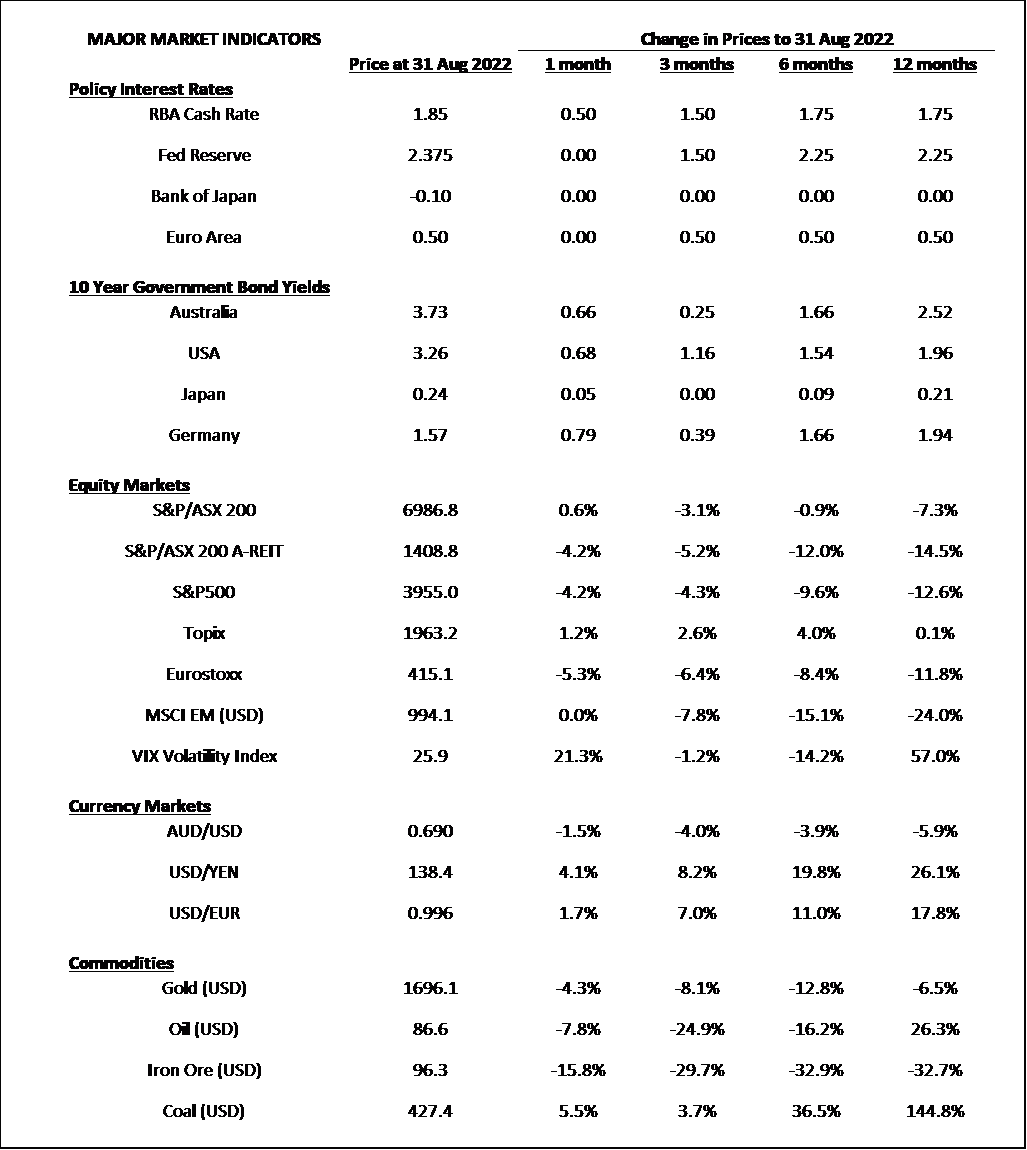

- Bond yields increased throughout August providing further poor returns for this asset class. However, with 10-year government bonds trading over 3% in both Australia and USA, this asset class is looking attractive if we believe inflation will eventually revert to the Reserve Bank target of 2% to 3%.

- Higher cash rates continued from USA (now 2.35%), Australia (increased to 2.35% on 6 Sep) and this will result in slowing economies. In Australia, there are many signs of declining residential property prices, which will likely continue given more interest rate rises are coming and particularly considering most economists believe the Australian cash rate will go over 3% by December 2022.

- European equity markets continue to suffer as high energy prices from the Russian/Ukraine war continue to strangle their economy.

- Taking a positive from all of the recent negative news, valuation levels across all markets are at historic average or below average levels.

Outlook

Votaility may continue but prepare for accepting greater risk

- The current market volatility will likely continue over the short term as higher interest rates from determined central banks continue to slow economies around the world.

- Slowing economies typically result in investment portfolios with higher quality investments tending to perform best. Higher quality means less risky bonds (e.g. investment grade), and equities with stronger balance sheets.

- With higher cash rates and higher bond yields, there is often pressure on equity market valuations and USA equities is the most expensive market in the world, whilst Australia and Emerging Markets are comparatively cheap.

- Considering the higher cash interest rates are still coming and their effects are yet to fully impact the economies of the world, there is still great uncertainty as where the vulnerabilities lie. This means we still believe prudent investment management means broad diversification and the avoidance of large bets or concentrated positions. That said, overall valuations are looking much better than at the start of the year, and when looking long term the expected returns for all asset classes look to be well above inflation and the time for increasing investment into riskier assets is getting closer.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL

491619