Market Snapshot: August 2023

In summary

A mixed month

-

Inflation hangs around as services inflation persists and the rate hikes by central banks are close to their top, but too early to call the

top.

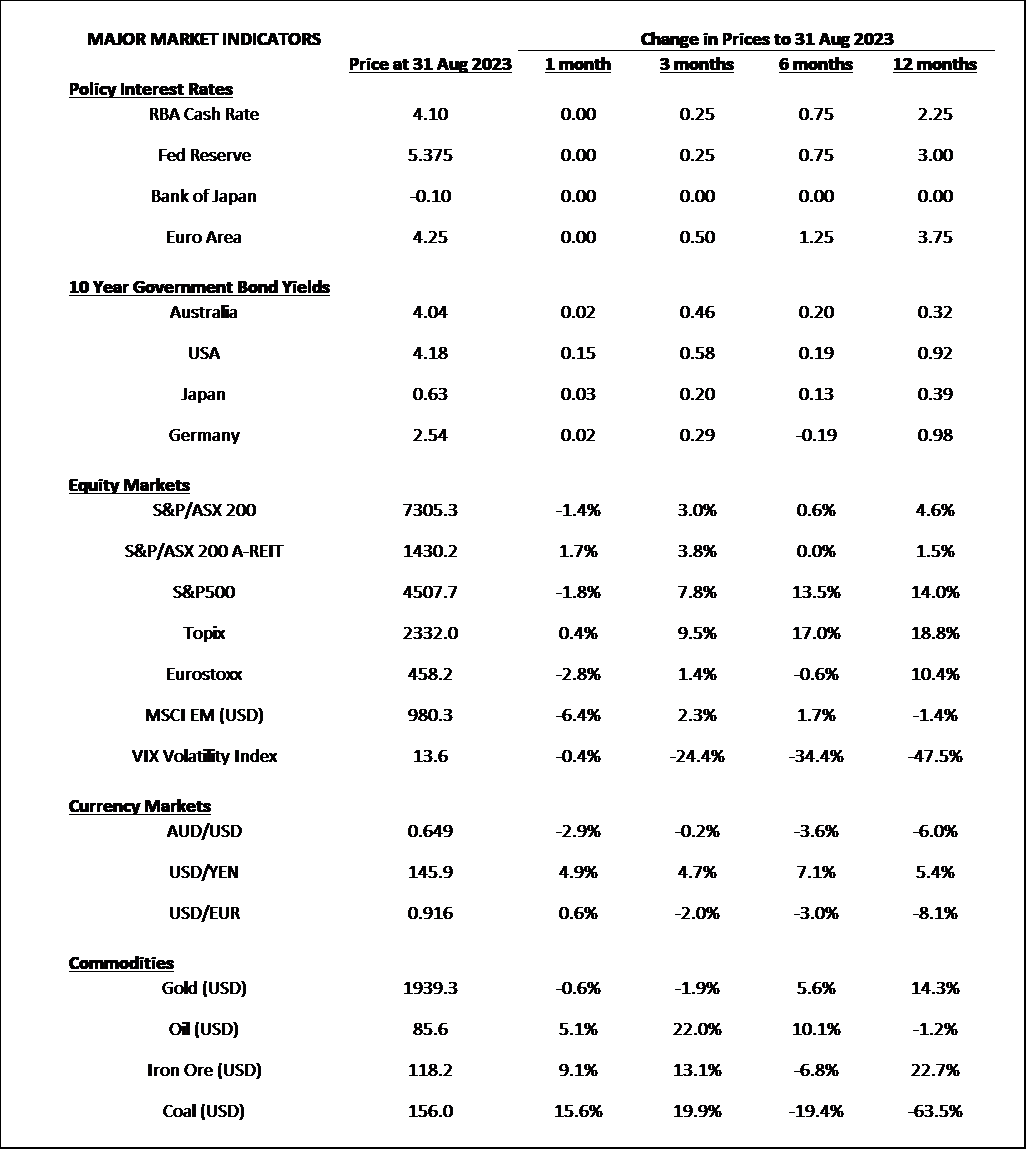

- Markets expect one more rise in USA and Australia by the end of 2023.

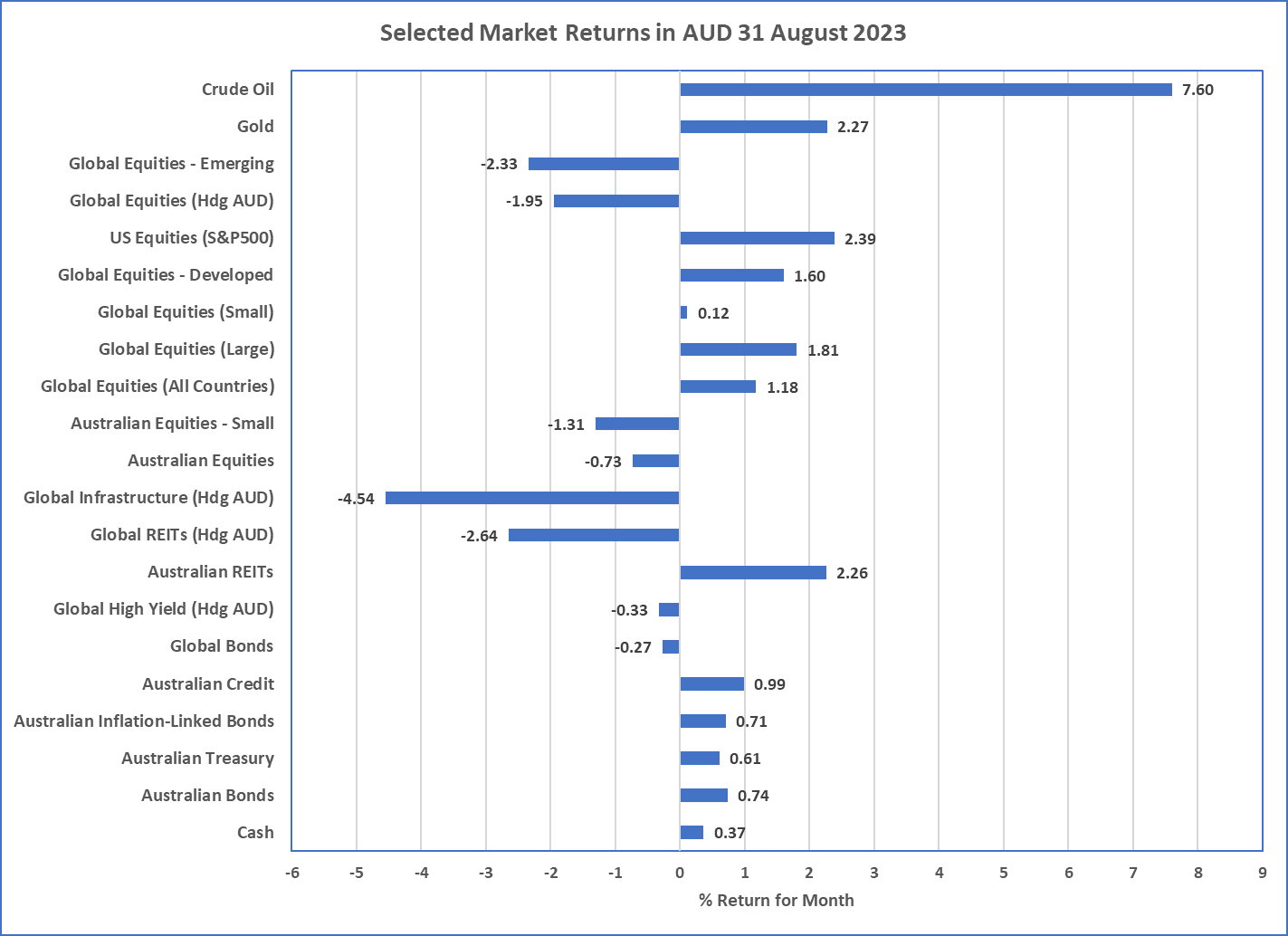

- The Australian dollar weakened off the back of Chinese and USA economic weakness which is also reflected in weaker returns from hedged risky asset classes (Property and Infrastructure) and Australian equities.

- Whilst Australian REITs produced good returns in August it was mostly due to their recent poor performance before expected bad revaluations were not as bad as forecast.

-

The month of August can almost be seen as market participants having a rebalance after a very strong 2023 for risky assets.

- The reality continues that USA sharemarkets have very high valuations in the face of a slowing global economy.

- Cash and Bonds are now yielding at levels to provide diversification to the sharemarket but also meaningful income for many investors.

- High valuations (i.e. USA shares) and slowing economies are a time for caution and our portfolios continue to be positioned for this with overweights to quality and lower priced assets compared to the broader market.

Chart 1: Holding US Dollars helped most of all

Source: Morningstar

What happened last month?

Markets & Economy

Chinese concerns for markets and services inflation key to peak interest rates.

- The main issue for Australia investors is the Chinese economy. Whilst many think fiscal stimulus will occur and therefore help Australia (& of course China), China’s main problem stems from the bankruptcy of several property developers so the usual stimulus for property spending is unlikely to occur given the massive oversupply. China’s population is in decline, has been overtaken by India and there is the longer-term possibility of a Japanese-like economic winter as deflation has appeared despite high inflation in the developed world. This is the issue of the day, suggests the Chinese economy may pause for a while and may result in strategic changes for investment portfolios.

-

USA inflation slightly increased last month from 3% in June to 3.2% in July, which was the first increase for around a year. Whilst

Australia targets 2%-3%, the US Federal Reserve targets 2% inflation so there is every chance of another rise or two by the US Fed from the

current 5.25% to 5.5% level, and the bond market suggests one more over the next few months.

- Whilst US inflation is relatively low at 3.2%, it is the services inflation number that is stickiest and has maintained high levels at 5.7%.

- In Australia, services inflation is at a 22-year high at 6.3% and higher than the 6% quarterly CPI and 4.9% monthly indicator. So, whilst the Reserve Bank has held cash rates at 4.1% over the last few months, it would be naïve to think the rate hikes have stopped. Like the USA, one or two more rate hikes is very possible by the end of 2023.

- Unemployment around the world has continued to stay relatively stable and low, although the USA has crept up slightly to 3.8% (from a low of 3.5%) whilst Australia hovers between 3.5% and 3.7%, which it has done for a little over 12 months.

- The above-mentioned mixed economic outputs, and naturally slowing economies have contributed to a mixed set of performances across asset classes, with the weakest performance coming from local and global sharemarkets and listed real assets (property and infrastructure).

Outlook

Cash and Bonds near peak yields

- Whilst the soft-landing possibility continues to occur, it still doesn’t match the high US sharemarket valuations which are priced for very strong growth. US sharemarket continues as the biggest risk from a valuation perspective, and the cushion of higher cash and bond yields is likely their strongest for some time and present as appropriate alternatives…particularly for income hungry investors.

- The Australian dollar declined in August and now sits around $0.63USD. Over the short term this decline could continue as risky asset volatility increases and the US dollar naturally strengthens, however a long-term view suggests the hedged currency positions in global equities may pay off as the longer-term average of the Aussie is around $0.76USD so there is downside from being unhedged long term.

- As stated in previous updates, it is essential for all portfolios to diversify across asset classes and securities with a focus on the long term. It has still been an incredibly strong 2023 for global equity returns, particularly USA growth, and current valuations suggest this is highly unlikely to continue. Higher sharemarket volatility should be expected as a minimum.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619