Market Snapshot: July 2022

In summary:

- July produced some excellent performance across all major investment asset classes, except Emerging Market equities (which were down a little over 1%).

- Part of this general market improvement was due to declining bond yields as global food and energy prices reduced, taking pressure of future inflation expectations.

- That said, inflation is still approaching 10% around the major developed economies as unemployment is low and wage inflation is increasing. The English central bank recently announced it expects their local inflation to reach 13%.

- With reducing bond yields, still above-average valuations in US Equities, rising cash rates, slowing economies and continued Russian/Ukraine war, it adds up to further financial market volatility in the not-so-distant future.

- We maintain our view to avoid making significant overweight or underweight positions and ensure portfolios are diversified with the comfort that long term, the expected returns are much higher than just a few months ago.

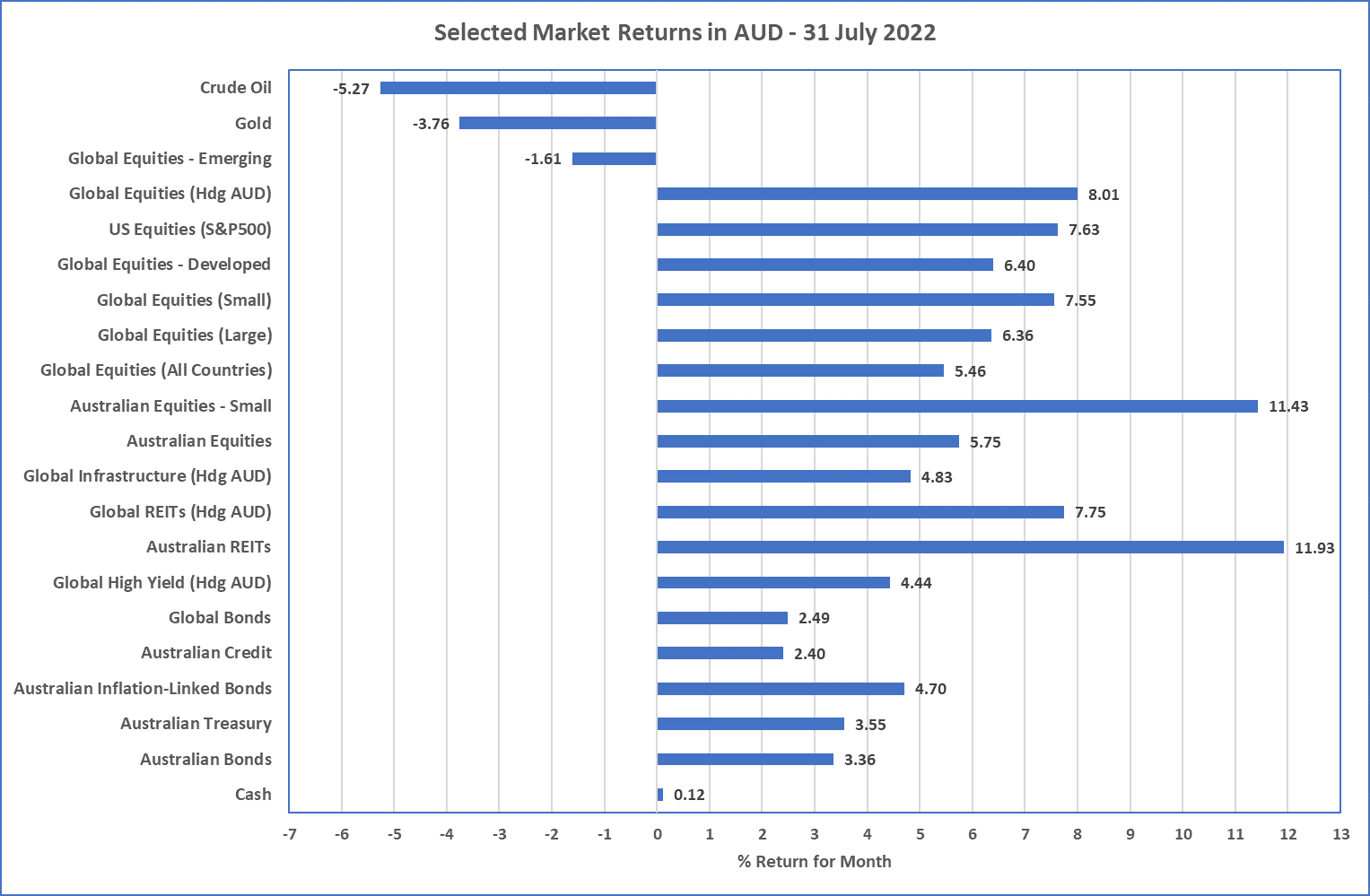

Chart 1: Another difficult month in traditional asset classes

Sources: Morningstar

What happened in June?

Markets & Economy

Markets bounce-back but will it persist?

-

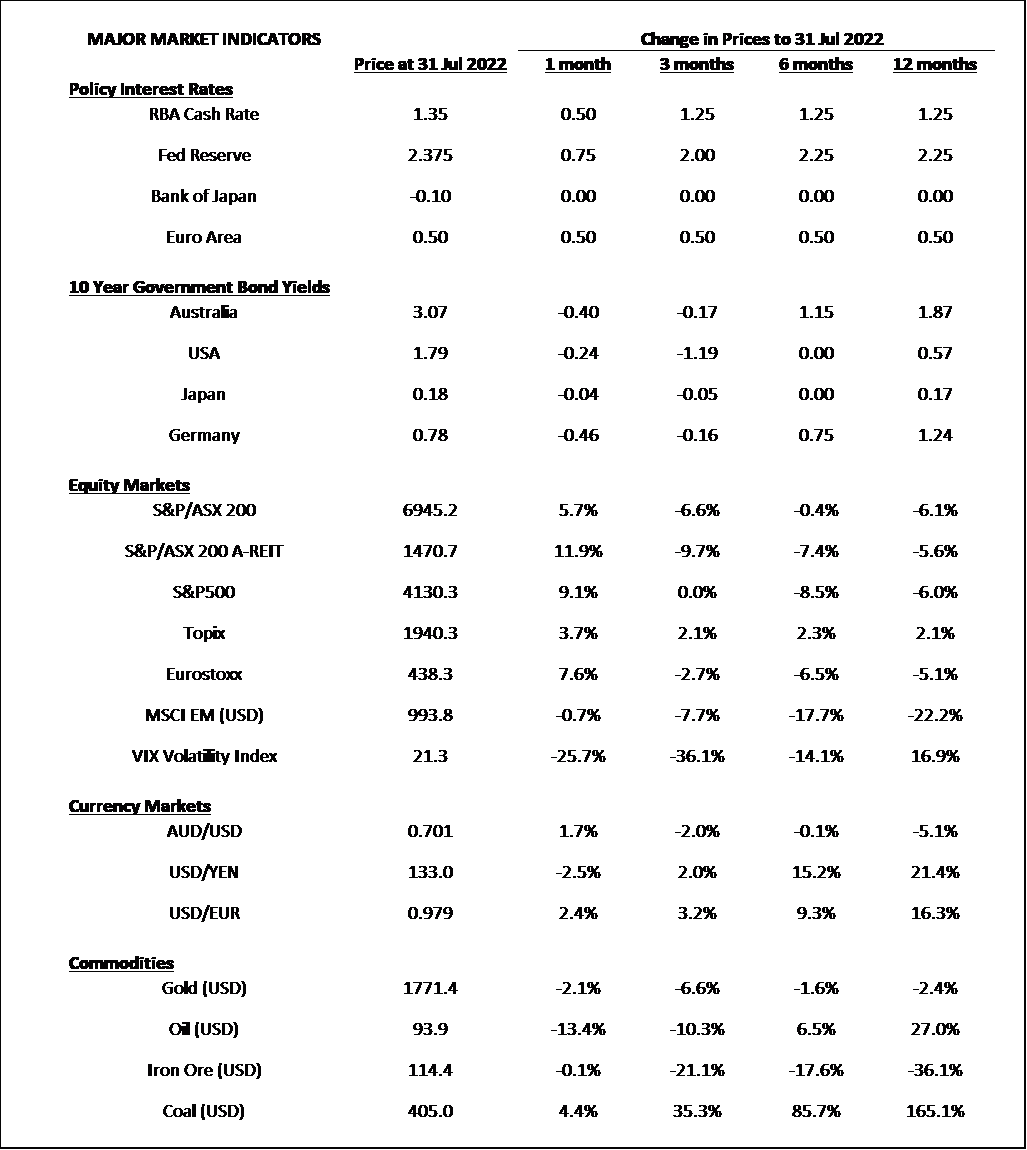

With a decline in Food and Energy prices over July, the outlook for inflation relaxed a little so bond yields declined by a lot

(Australian 10-year bonds down 0.40% and US 10-Year Bonds down 0.24%) which gave permission to equity markets to recover a little of its

2022 losses.

- Chart 1 shows all equity asset classes (except Emerging Market equities) increase between 5% and 12% with the best performing being the previous quarter's strugglers, Australia REITs and Australian Small Companies.

- This positive market outcome was in spite of some bad economic reporting. The US economy sank to its second negative quarter in a row, and even China’s economy sank 2.6% for the quarter. The International Monetary Fund (IMF) has reduced economic growth across the world and said the world is on the brink of recession.

- The only reason the US Hasn’t declared recession is their unemployment is at 3.5% with high levels of job openings, but this is a double edge sword as the low unemployment is feeding into higher inflation as wages growth continues above 10% suggesting inflation could well shift above 10% depending on food and energy price effects.

Pandemic

A new variant and increasing cases

- With Australia’s covid numbers starting to reduce again as winter nears the end, and the northern hemisphere having lower numbers thanks to its warmer weather, the pandemic is very much in the background in terms of financial markets.

Outlook

- The decline in long term bond yields is a poor sign for the economy as US 10-year yields are well below both 2-year and 3-year yields (2.8% vs 3.3% and 3.2%, respectively) and this is the bond market predicting recession, so it doesn’t augur well.

- Contrary to bond markets is equity market rebound currently underway and combined with their historically above-average valuations in the USA suggests all is well and recovering.

- With the Russian/Ukraine war continuing with little sign of resolution, the European economy is under stress and likely already in recession and likely to get worse.

- The likely outcome following the strong performance month of July is the higher volatility of equity markets soon resumes, central banks continue their increase in rates to control inflation, and economies continue to worsen.

- These recent mixed messages suggest the prudent decision is to maintain diversification and avoid large overweight or underweight positions, expect this volatility, forget the recent losses, and know the long-term returns look much better than just a few months ago.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619