Market Snapshot: July 2025

Summary:

Maintain diversification … tariff headwinds versus artificial intelligence momentum

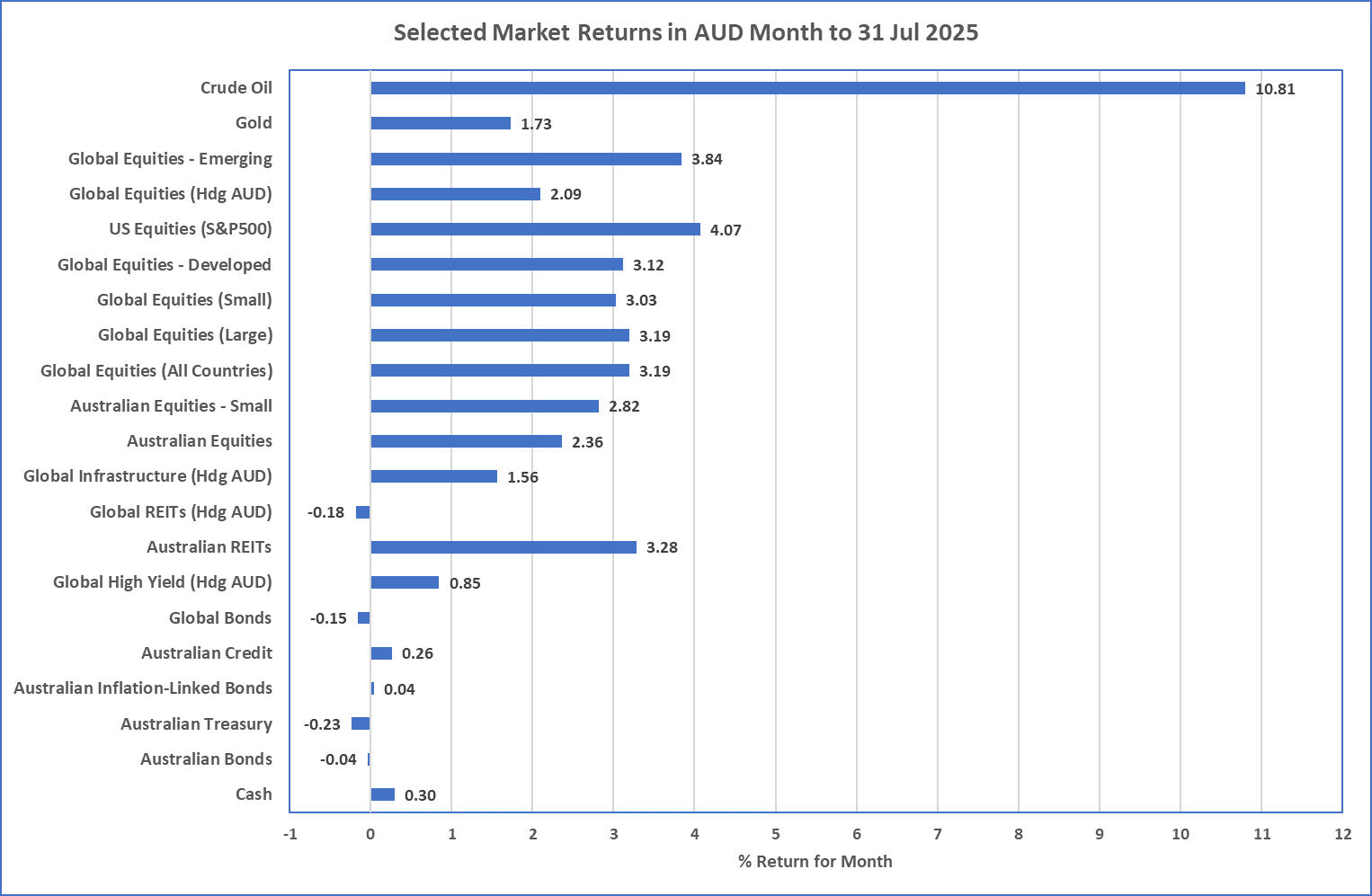

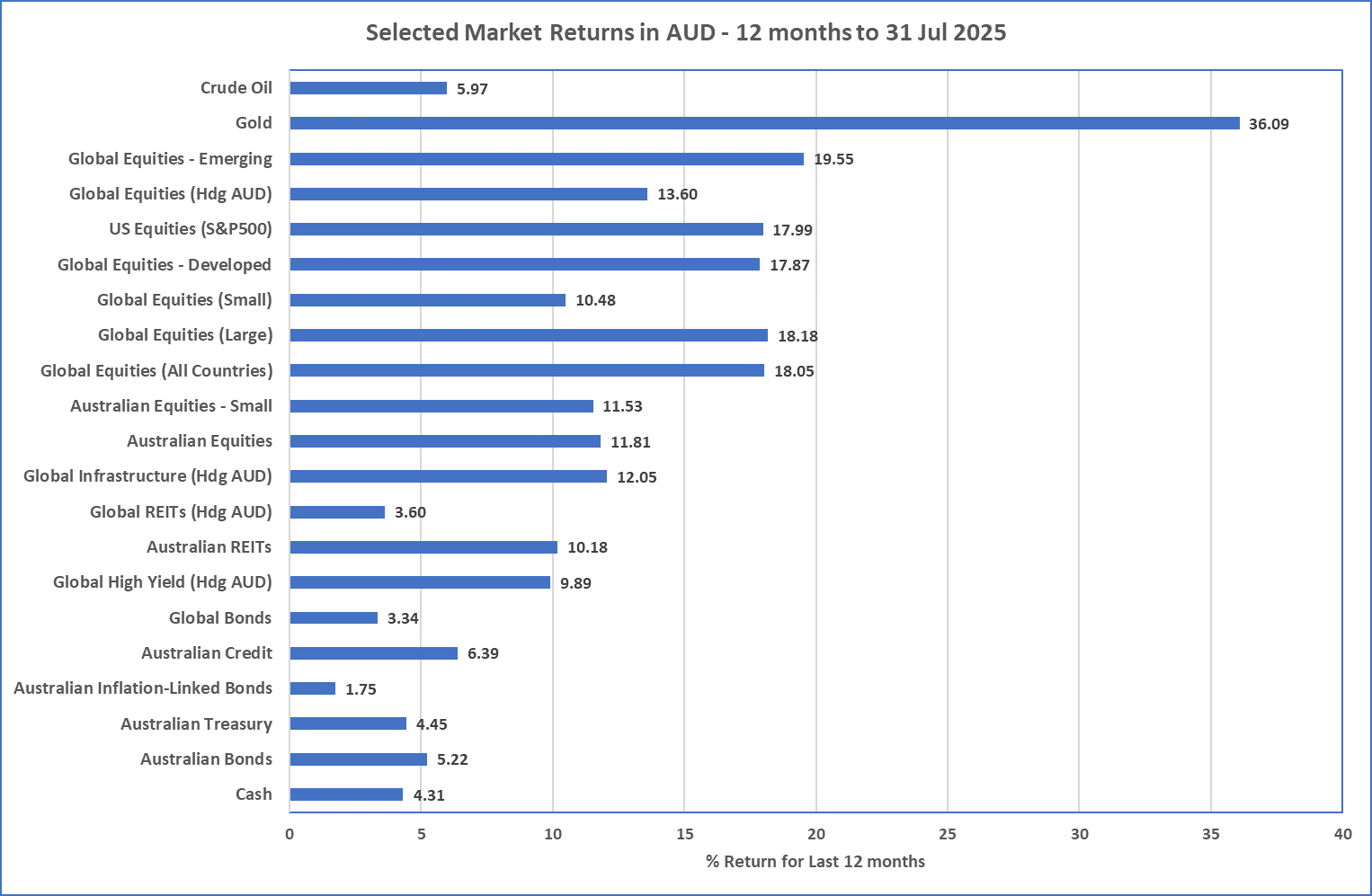

- Tariffs are back on but the sharemarkets appear unconcerned as they produced a very strong result around the world. The MSCI World was up a little over 3%, Emerging Markets up almost 4%, and Australian shares increased ~2.4%.

- Aside from Australian REITs (that appear driven by the AI Boom thanks to Goodman Group), interest rate sensitive markets like bonds, and global property were relatively flat over July. Cash rates were steady around the major markets as central banks await the tariff proposals from the Trump administration.

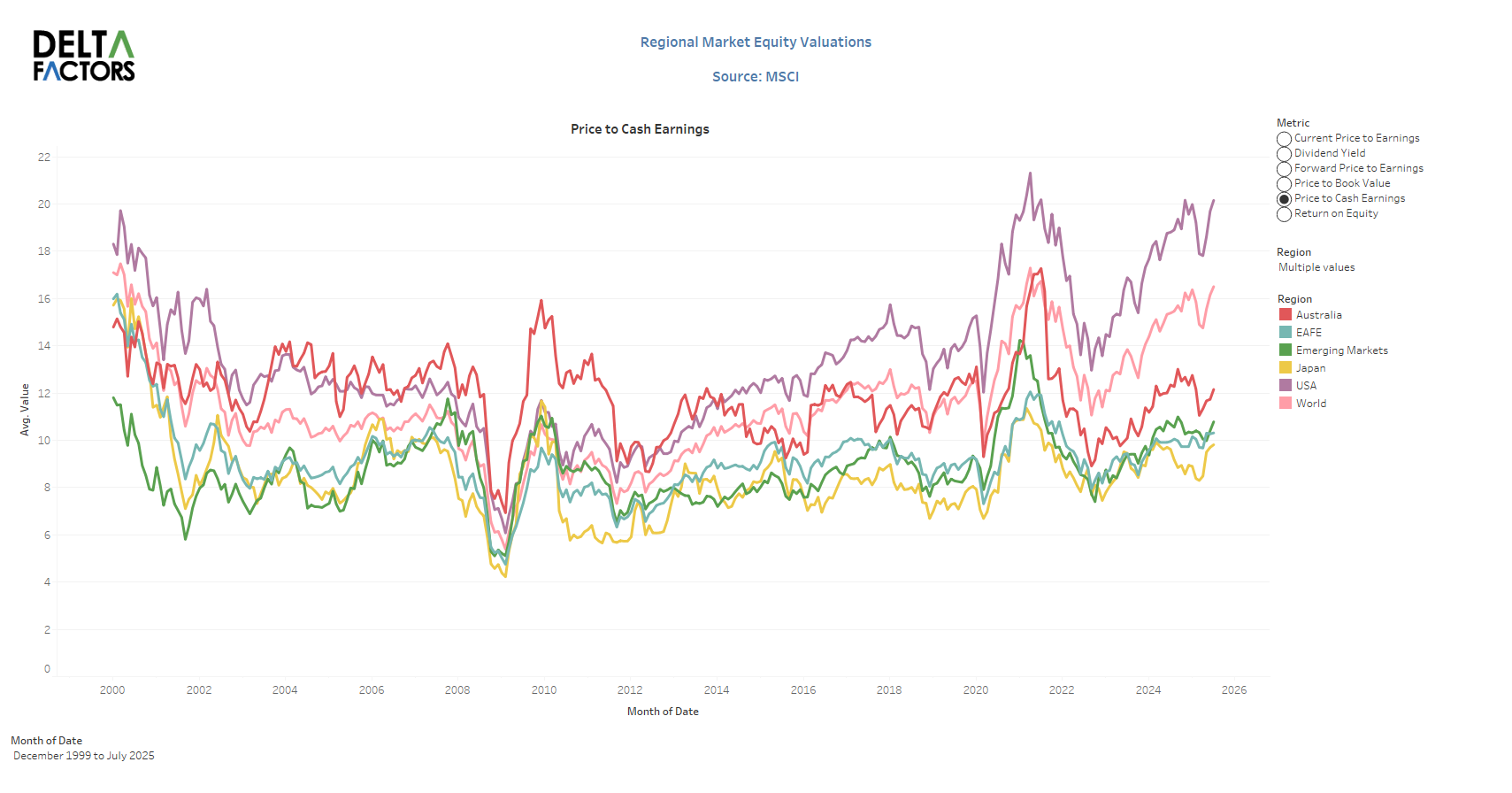

- Looking ahead whilst cash rates decline, we believe riskier markets will increase in volatility as weaker global economic data is likely for the second half of 2025. As shown later in this report, USA sharemarket valuations are amongst the highest this century and may influence a bearish outlook for many investors, but many on Wall St still believe the tariffs won’t go through!

- Our core investment message today is to maintain diversification, focus on the long term, and regularly rebalance. Major risks continue to lie with expensive sharemarkets, including large companies of the USA, and we continue to favour quality (i.e. good profitability) and value (i.e. “cheap”) styles for long term investments in shares. Quality bonds are preferred as higher yielding below-investment grade bonds provide a historically low premium.

Chart 1 … An excellent month for shares but less so the interest rate sensitive

Source: Morningstar

What happened last month?

Markets & Economy

- July was the month when most of the tariff deals were to be announced but there were really none of substance forthcoming so there have been more tariff delays and a variety of increased tariffs in the USA announced. At 7 August, the Yale Budget Lab analysis says “consumers face an overall effective tariff rate of 18.6%, the highest since 1933. After consumption shifts, the average tariff rate will be 17.7%, the highest since 1934”.

- Other tariff effects include an “expected rise in price levels by around 1.8% over the short term assuming the Federal Reserve does not change rates. Tariffs on apparel prices are expected to increase their prices by 37% and shoes are to increase by around 39%. “

- In the long run the US economy is expected to be persistently 0.4% smaller. Finally, US unemployment is expected to rise another 1% by the end of 2026.

- Despite this negative tariff news for the USA, sharemarkets around the world were resilient in July generally producing very strong returns from 2% to almost 5%. There was very little volatility and there appears to be a complacency as market valuations are near record highs since the start of this century. It is a battle between an artificial intelligence capital expenditure and expected productivity boom and the headwind of tariffs.

- The higher tariffs resulted in the Federal Reserve keeping US cash rates steady, much to the frustration of the US administration but this resulting in a little bond market volatility that also kept the interest rate sensitive real assets, like Global Property and Infrastructure, from achieving the strong returns of the rest of the sharemarket.

Outlook …US Sharemarket valuations remain the concern

- As the chart titled 'Regional Market Equity Valuations' at the end of this article shows, the US Sharemarket has valuations heading towards the pre-correction 2021 levels and are near the highest valuations this century. Other markets, including Australia appear fully valued, although Europe, Japan and Emerging Markets appear somewhat fairly valued.

- The tariff agenda is back on and these near 100-year record levels in the USA will likely result in weaker economic data out of the USA during this 3rd quarter as the true effects didn’t really start until May/June. Expected weak data may result in increased volatility across all markets, whether shares or bonds, but the Artificial Intelligence capital expenditure may cushion the true economic effects of tariffs.

- Inflation in Australia has reduced a little more (2.4% down to 2.1%) and current pricing suggests the Reserve Bank of Australia will reduce rates to around 3.1% by the end of 2025 or early 2026. As mentioned last month, the US tariff regime may result in some deflationary pressure in Australia as China looks to dump cheap goods.

- Overall, the general portfolio preferences are unchanged and centres on diversification. Volatile markets are likely to continue, and diversification continues to be essential in this environment, whether shares, bonds, real assets, as well as across regions and broader asset class levels. Over the long-term, we believe valuation matters and this continues to be another central theme for investment today.

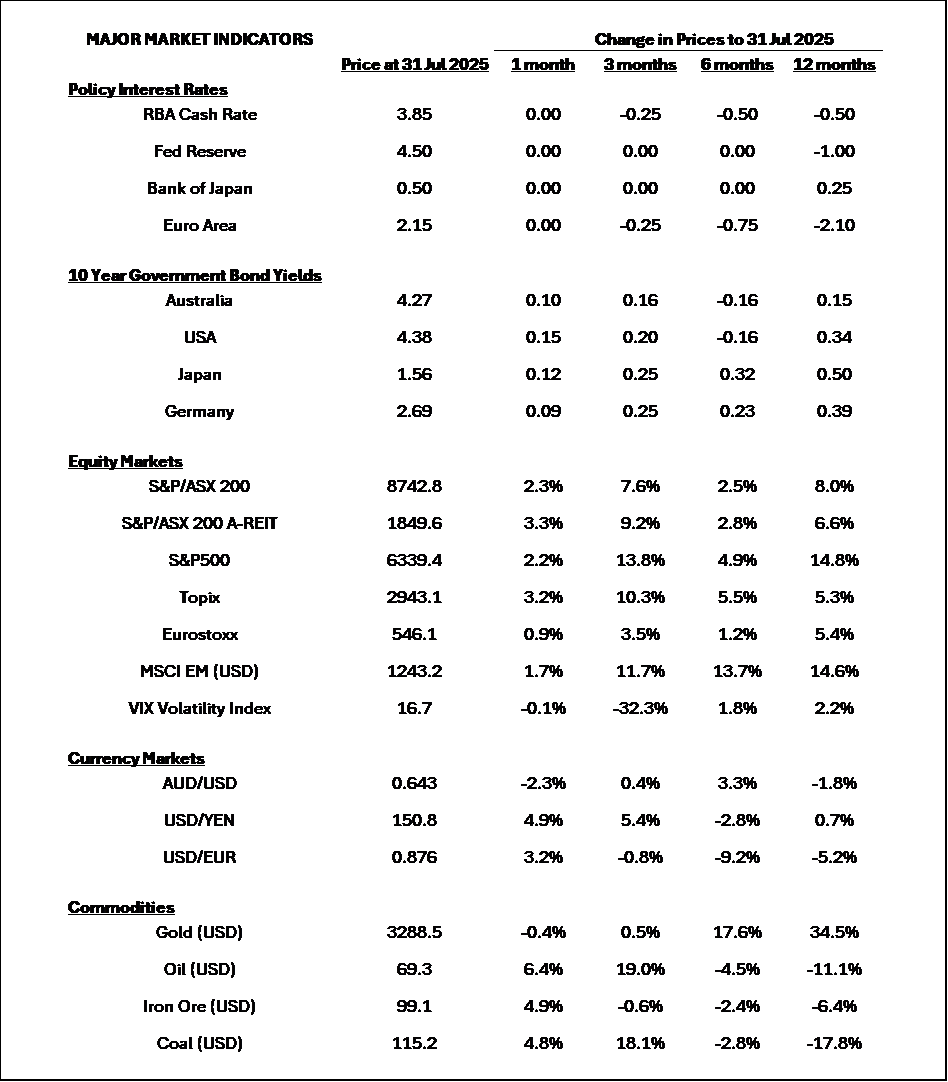

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

Source: Morningstar

Source: Delta Research and Advisory , MSCI

McConachie Stedman Financial Planning Pty Ltd is a Corporate Authorised Representative of MCS Financial Planning Pty Ltd | ABN 11 677 710

600 | AFSL 560040

General Advice Warning

The information provided in this article is for general information purposes only and is not intended to and does not constitute formal

taxation, financial or accounting advice. McConachie Stedman does not give any guarantee, warranty or make any representation that the

information is fit for a particular purpose. As such, you should not make any investment or other financial decision in reliance upon the

information set out in this correspondence and should seek professional advice on the financial, legal and taxation implications before

making any such decisions