Market Snapshot: June 2021

In summary

- The Global COVID-19 situation continues to improve in line with vaccination rollout and despite a more contagious variant (Delta) coming to the fore in every country. Those regions showing highest case and death rates are those with low levels of vaccination.

- Government bond yields continued to decline in the USA and Australia suggesting inflation is now less of a concern than it was in February. That said, unemployment has significantly reduced across the world so the question is, will wage inflation reappear and drive up broader longer term inflation expectations? At this stage, it is impossible to tell but it may be an important indicator to future equity market volatility and interest rates (i.e. high inflation will create volatility and higher interest rates).

-

Risky assets continued their strong return momentum for another month with monetary and fiscal stimulus still strong drivers of most risky

markets.

- US equity market valuations appear to carry the biggest downside risk and may be the catalyst of any potential correction but whether one occurs or not, future return expectations should be much lower than recent performance experience.

- Our portfolios have maintained their neutral position on risky assets and, where appropriate, are rebalancing to strategic weights.

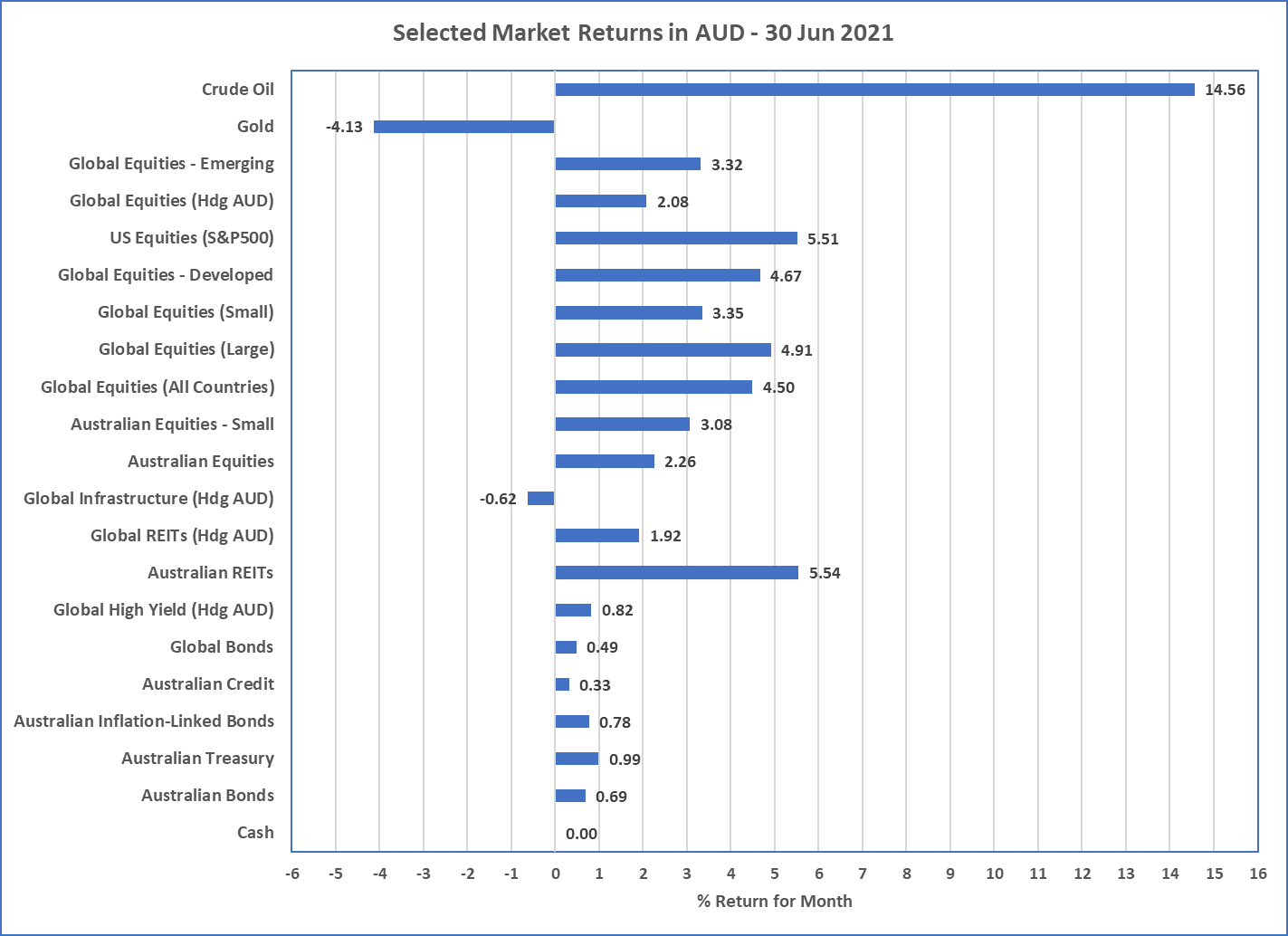

Chart 1: Two months in a row for positive returns

Sources: Morningstar Direct

What happened in April?

Pandemic

Australia is now the laggard.

- The month of June saw the Delta variant of COVID-19 dominate the global pandemic and particularly in Australia where multiple lockdowns have occurred around the country. This variant has shown to be the most contagious and is the biggest threat to the unvaccinated.

- Strong vaccinations in across Europe and the USA has shown their economies starting to open up a little more. Unfortunately, Australia has become the global pandemic laggard as vaccination messages have been mixed and take-up has been much slower than hoped as the federal government has struggled to gain sufficient supply from Pfizer and others.

- Covid-19 remains the biggest economic threat worldwide.

Markets

Risky asset price momentum marches on

- With the exception of Gold (down ~4%), almost all risky asset classes showed strong returns during June. This was largely driven by continued fiscal and monetary stimulus as well as increased confidence as successful vaccination showed significantly lower case and death rates.

- Bond yields have continued to decline from its February/March highs which continues the market’s belief that inflation is likely to be transitory, as opposed to sustained, in the Post-COVID economy. Higher inflation means higher interest rates but not yet.

- The Australian dollar weakened against the US Dollar and trades around $0.75USD after many thought earlier in the year it was heading over $0.80USD. This weakness is more to due with US economic strength as Iron Ore prices continue to hit record highs (currently ~$214USD) which would normally increase AUD strength.

- Whilst risky assets continue to increase in price it only adds to increased risks of a valuation-based correction. Momentum, Fiscal and Monetary support appear to be on the side of short-term performance for equities but the longer term outlook for strong returns are diminishing.

- Other risks to the current momentum may be higher than expected inflation or some unexpected earnings downgrades. Certainly, the US market to be priced for perfection and priced for very high growth.

Economies

Improvement everywhere.

- The top 33 economies by size (i.e. USA to Egypt) are all currently running budget deficits as government debt levels continue to play second fiddle to the focus on getting economies back to normal.

- The key to this continues to be the recovery to COVID and the vaccination rollout is the crucial part of this.

- Unemployment continues to improve everywhere and a return to near full employment appears closer than anyone would have expected last year. This may be the catalyst behind any inflation outbreak but at this stage wage inflation appears somewhat under control.

- Australia’s unemployment dropped sharply to 5.1% and the latest inflation figures (1.1%) do not present too many concerns.

Outlook

The world economic outlook maintains its strength whilst equity markets carry this momentum from stimulus but with concerns around valuations, particularly in the USA.

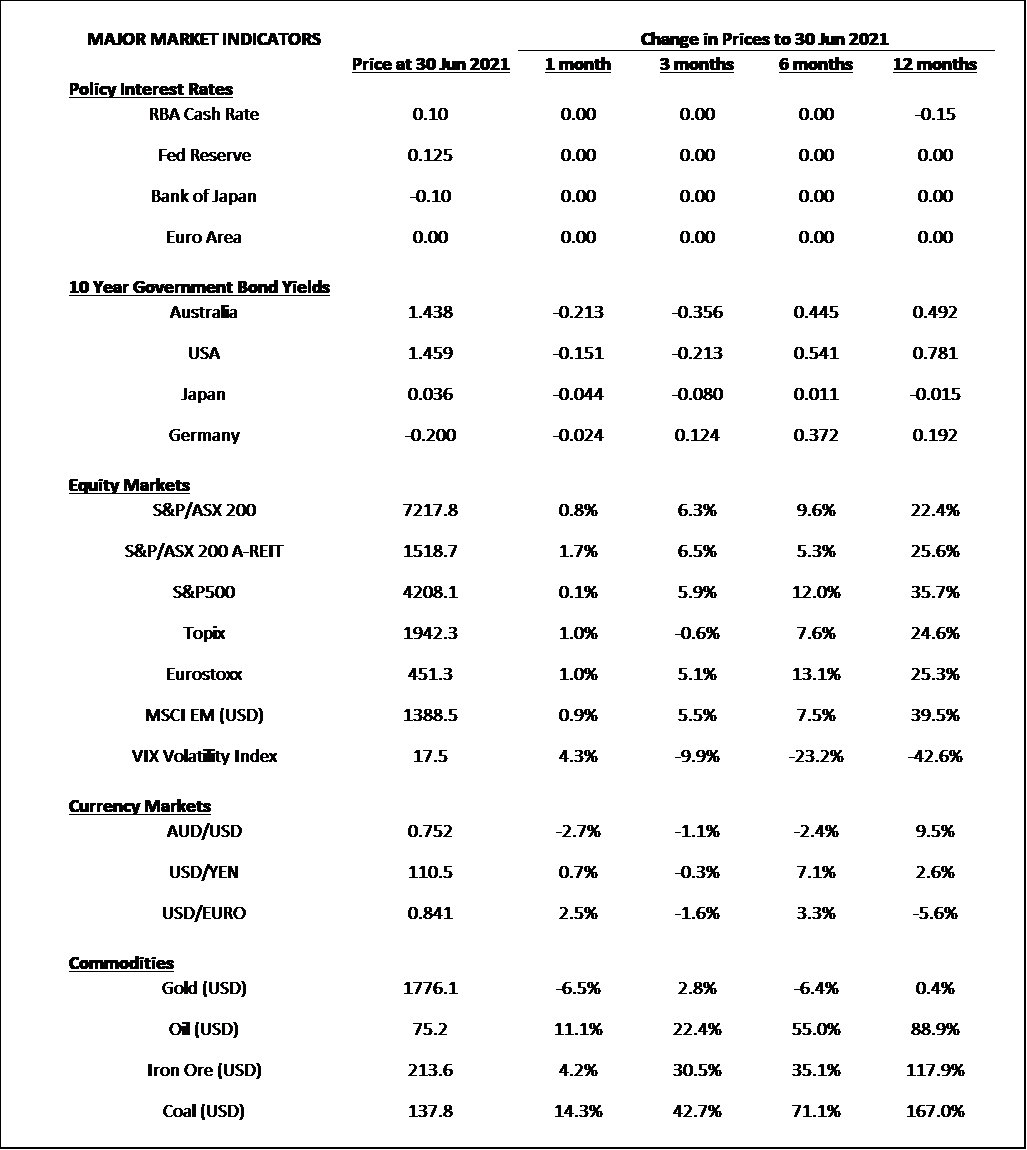

Bond yields have, surprisingly, dropped significantly over the last month, and this suggests the outlook to inflation is for lower than previously thought across Australia, USA, and UK.

There continues to be little incentive to increase risky asset allocations and maintaining neutral position between risky and not-risky assets is preferred for now.

Significant deviations from strategic allocation weights are rebalanced.

Major Market Indicators

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619