Market Snapshot: June 2023

In summary

Soft landing in USA increasingly likely

- High inflation continues around the world but is thankfully declining. Latest inflation in the USA was a multi-year low of 4% and in Australia, the monthly inflation indicator, is down to 5.6%. Both figures are well above targets, but the current trend combined with low unemployment still provides hope of an economic soft landing in both USA and Australia.

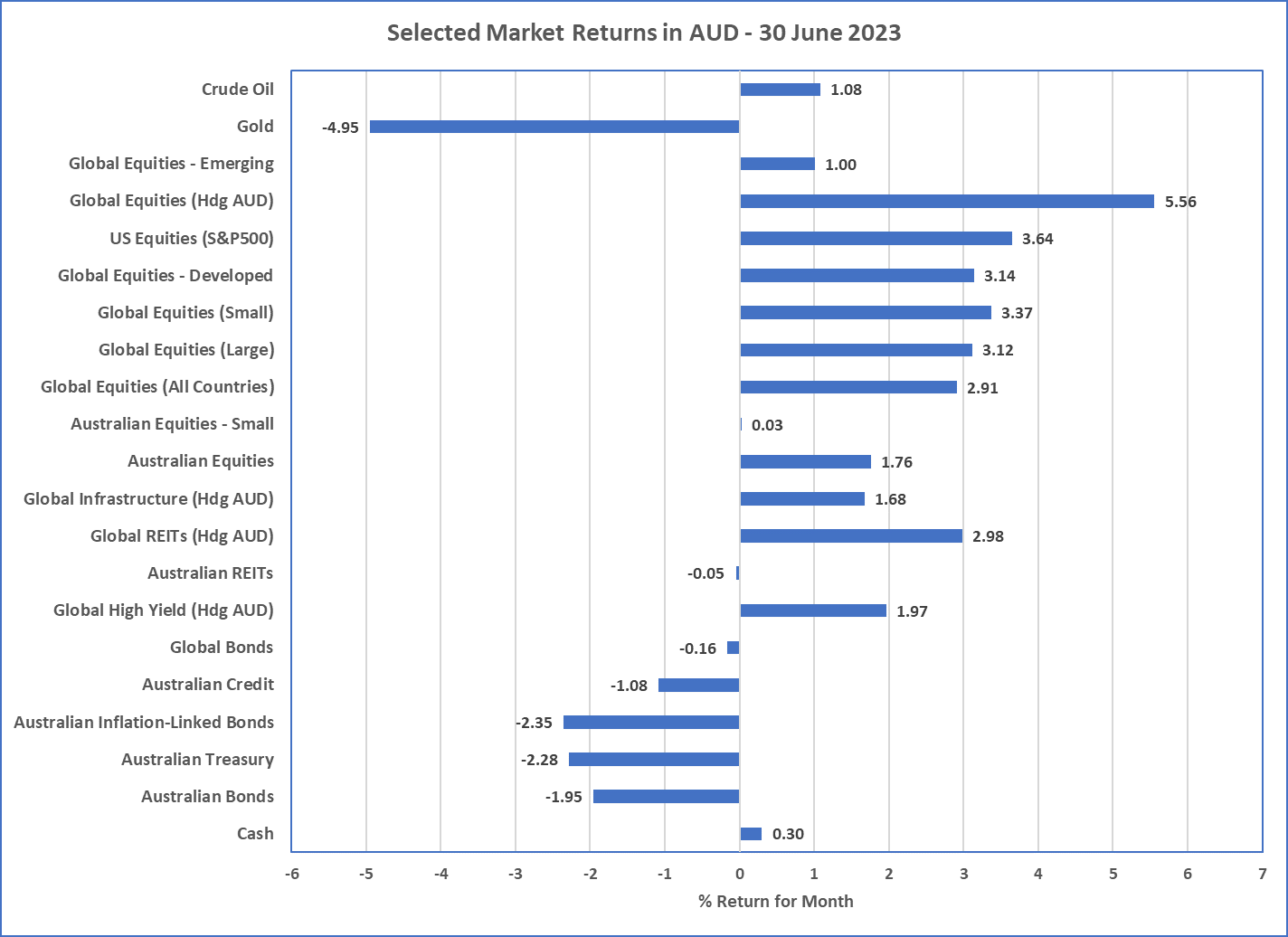

- Sharemarkets generally performed well in June, but rising bond yields around the world resulted in negative bond-market returns. Global High Yield, which normally correlates positively with equities, performed strongly, suggesting investors in risky assets aren’t seeing any recession.

-

Market expectations demand caution on sharemarkets as valuations do not reflect economic risks. Higher investment market volatility across

all asset classes is expected as the global economy slows during the latter half of 2023 and higher interest rates continue to bite.

- From a valuation perspective, we continue preferences away from the most expensive markets which continue to be US Equities (particularly growth/tech) and High Yield. Please see Page 4 of this update for record Growth vs Value valuation differences.

- High quality securities (defined by good profitability and strong balance sheets) have performed very strongly in 2023, may provide some recession protection ... which supports some (but not all) US Tech, reinforcing diversification, not concentration.

-

Bond yields have increased substantially over recent weeks and increasing duration in bond portfolios is appealing. However, with cash

rates still expected to increase, there is no hurry.

Source: Morningstar

What happened last month?

Markets & Economy

Soft landing in USA increasingly likely

- Inflation in the USA has decreased substantially dropping from 4.9% to 4% which is the lowest level since March 2021 and slightly below surveyed expectations. This decline was driven by a decline in energy prices which have not stayed high despite the Russian/Ukraine war. Over the last 12 months oil prices have reduced by around 40%.

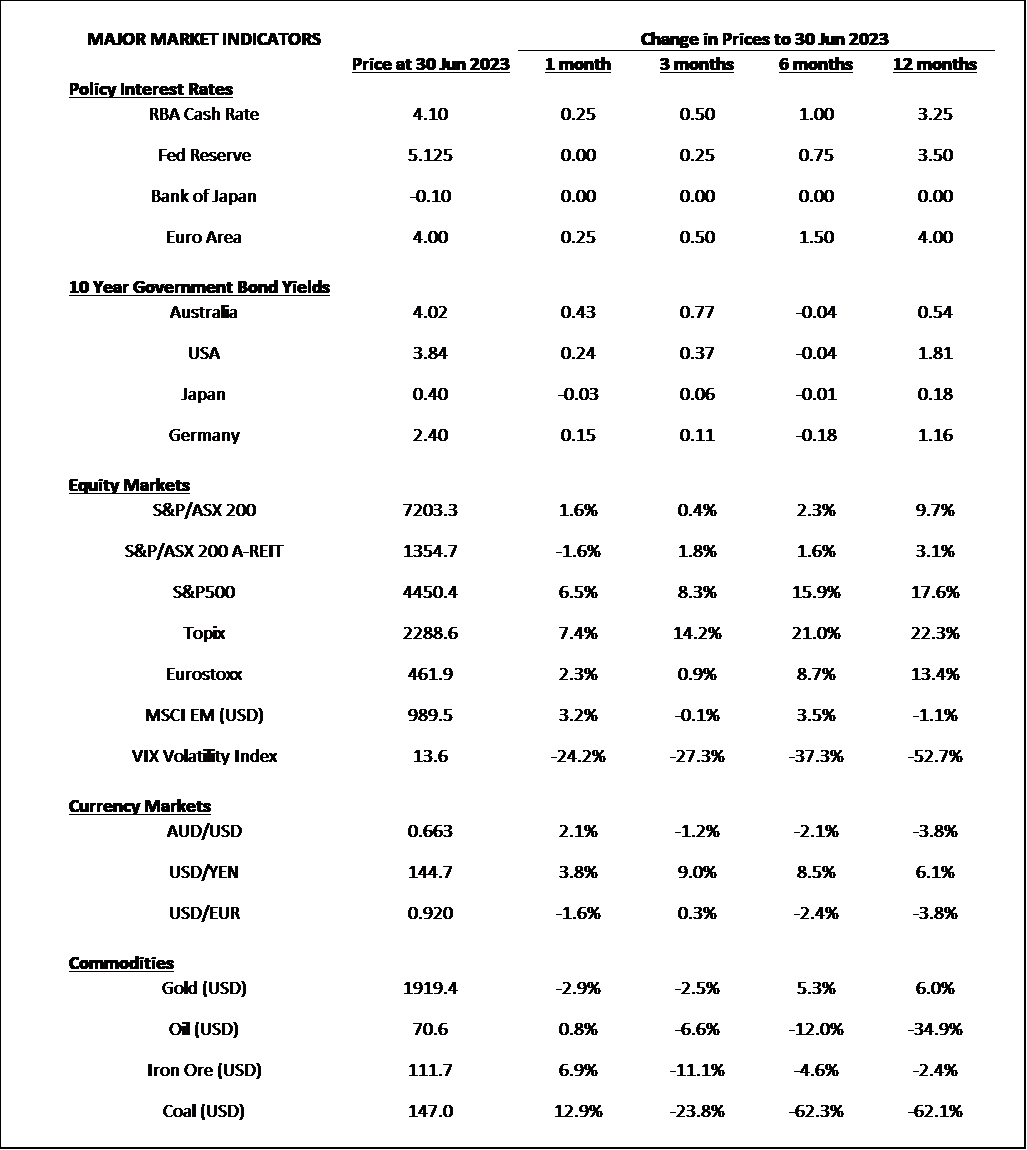

- Lower inflation provides the Federal Reserve an opportunity to pause their rate increases, although they continue to talk higher rates (and talk is their other lever). This combination resulted in the bond market shifting to their highest yields in the USA since before the GFC.

- With US unemployment staying at a very low 3.6%, job vacancies still relatively high, it is likely the Federal Reserve will maintain the rage and increase rates to ensure inflation is smashed. The only current catalyst for recession is the enforced economic slowdown by the Fed’s rate rises, and higher interest rates must place pressure on valuations of all asset prices and slow broad-based spending.

- In Australia, the RBA paused in July after increasing by another 25bps in June to place cash rates at 4.1%. The Bond yield curve is relatively flat suggesting a weak economy is before us. That said, like overseas, Australian bond yields have increased across all maturities making them more appealing for income investors.

- Despite the increased yields in fixed interest markets, sharemarkets had a strong June both overseas and Australia. Rising bond yields and rising sharemarkets are sometimes a sign of economic strength so after recession talk for many months, the current combination of stable unemployment and lower inflation augurs well for a potential soft landing in the USA.

Outlook

Diversification, not concentration

- There is some comfort in the recent stronger than expected economic data including lower US inflation. However, rising central bank interest rates in the USA have resulted in recession 11 out of the last 14 times. However, if there is recession it has probably pushed back another 6 months. Caution remains.

- Sharemarkets in the USA are still historically expensive with strong returns mostly coming from the large cap tech sector. This also results in risky asset caution, continued need for diversification, and extreme focus to avoid the disease of FOMO (fear of missing out). Please note the additional chart on Page 4 of this update … growth securities in the USA are their most expensive compared to Value since the Tech Wreck which was around 23 years ago! Further strong returns in growth securities should be limited from current valuation levels.

- Long term bond markets are providing appealing yields although aren’t much different to Australian cash rates. So, our current preference is for diversification across different terms to maturity and longer duration will increasingly likely cushion equity market risks. We believe upward pressure on Cash rates will continue so Cash is still the current King.

- As stated in previous updates, it is essential for all portfolios to diversify across asset classes and securities with a focus on the long term. It’s been an incredibly strong 2023 for global equity returns, particularly USA growth, but current valuations suggest this is highly unlikely to continue.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619