Market Snapshot: May 2024

In summary

Low Growth, High Rates, High Valuation?

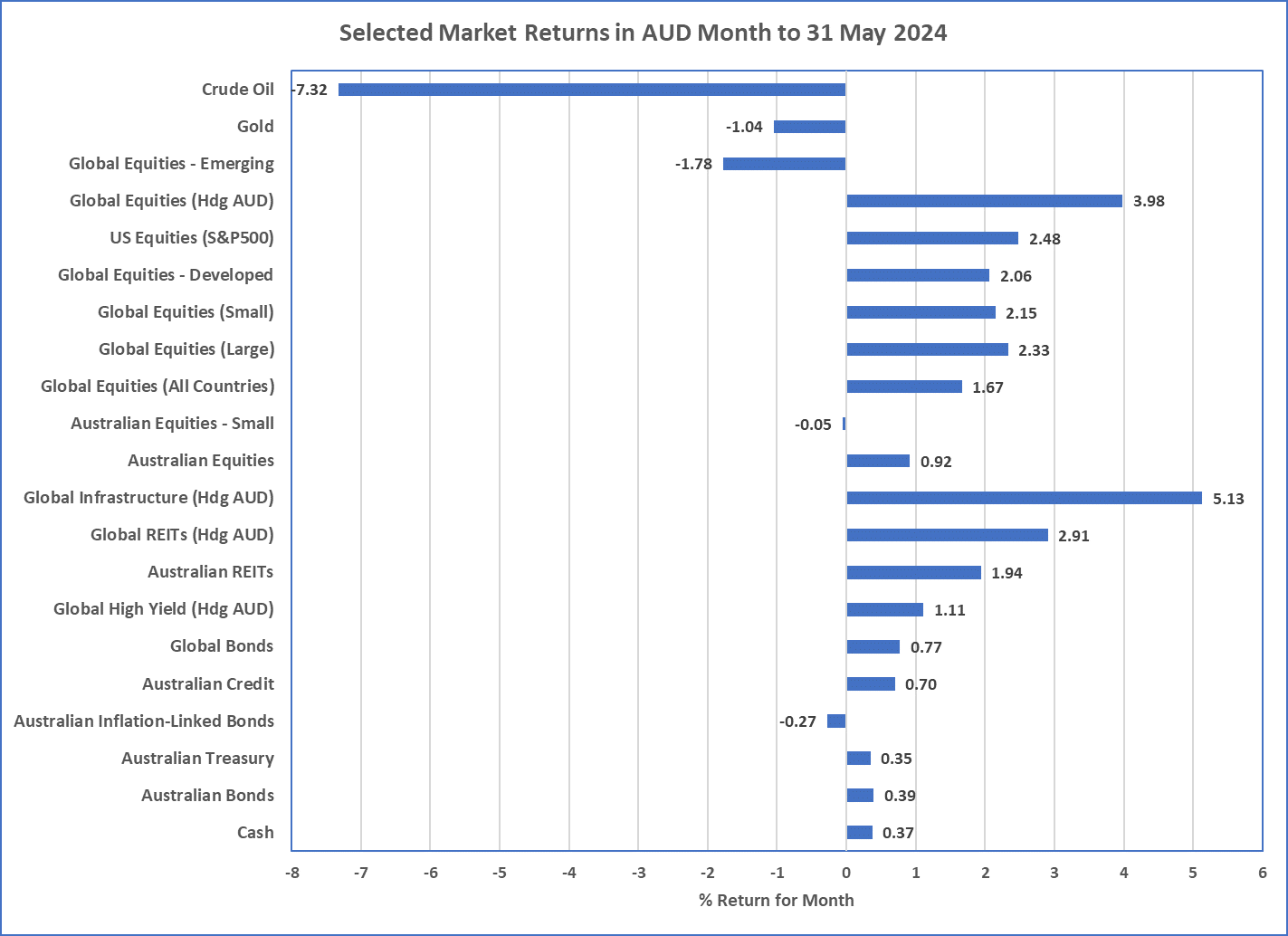

- After a challenging month in April, the investment experience was almost the complete opposite return experience during May. Most major asset classes, whether bonds and shares, produced positive returns whilst negative returns came from Emerging Markets, Gold and Oil.

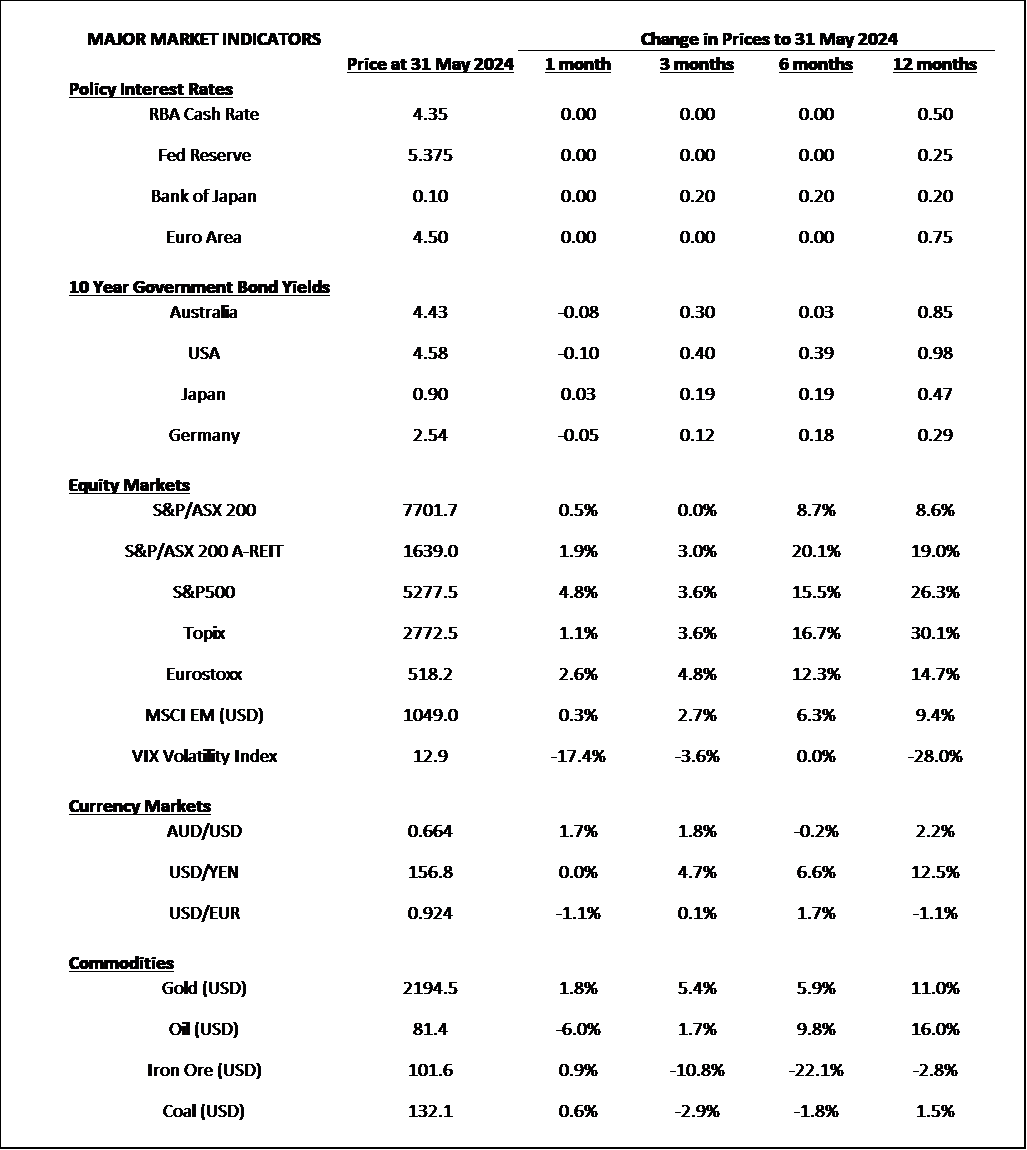

- Inflation persists at relatively high levels in Australian and USA (3.6% and 3.4%, respectively), and recent economic growth amongst developed markets is at below average levels. Australia’s economic growth for the March quarter was only 0.1% providing media talk of stagflation, which is a stagnant economy combined with high inflation.

- As mentioned last month, both USA and Australia now appear unlikely to reduce its cash rates in 2024, although the European Central Bank (ECB) did reduce their cash rate by 0.25% in the first week of June, as economic growth has become the focus in Europe over inflation (which is currently near target at ~2.6%)

- Bond yield curves around the world continue to be sloped negatively which is not a strong economic indicator, and the higher cash rates are appealing for defensive investors.

- For sharemarket investors the Artificial Intelligence darling, NVIDIA, continues to dominate returns and positive momentum has placed US sharemarket valuations near record highs. This defines the investor’s biggest risk as high valuations tend to precede lower returns.

- There appears to be a few strong buying opportunities across markets and investment portfolio preferences continue towards diversification across asset classes and securities. Lower valuation and higher quality continue as preferred overweights for the long term.

Chart 1: The complete opposite of April?

Source: Morningstar

What happened last month?

Markets & Economy

-

After a brief pause by sharemarkets in April the month of May was different as sharemarkets resumed their positive momentum from previous

months and the artificial intelligence juggernaut, i.e. of NVIDIA, increased more than 25%, helping the US sharemarket (S&P500) to a

near 5% US Dollar return in May.

- The Australian sharemarket produced almost 1% return whilst Emerging Markets were down almost 2% in Australian dollars.

- Australian economic growth results for the March quarter were a little weaker than expected coming in at only 0.1% growth quarter on quarter. This was the weakest growth result since the 3rd quarter of 2022 which was also 0.1%. Over the previous 12 months, the Australian economy has grown only 1.1% which is much below longer-term averages. Considering higher than desired inflation continues, everyone should expect the term, stagflation (meaning stagnant economy and high inflation), to be mentioned more and more during 2024.

- Currently all developed markets have shown weaker than average economic growth results to the end of March, as the impact of the higher interest rate over the last couple of years takes hold.

- Global and Australian Bond market returns were up 0.7% and 0.3%, respectively, during May which showed little movement in yields. Cash continues to yield higher than longer term bonds and appears the more appealing defensive allocation whilst inflation persists.

- The strong performer for May was Global Infrastructure, which has been the weakest performing asset class over the last 12 months.

Outlook

Holding firm …

- The paradox of markets and economies continues as high US sharemarket valuations persist in the face of high interest rates and now slowing economies. The current sharemarket momentum may continue over the short term but longer-term growth at above-average levels appears increasingly unlikely.

- Uncertainty about persistent inflation suggests sharemarket volatility should increase but this is counter to current low levels of the S&P500 VIX Index (i.e. Volatility index). The risks around stagflation appear to be increasing and geopolitical risks around the Middle East continue.

- As mentioned last month, this doesn’t mean to change any long-term investment strategy, but it is important to ensure portfolios are well diversified to avoid/reduce concentrated risks or risks of the unknown.

- The central bank focus remains on inflation, and economic growth concerns are still secondary but increasing in importance. This may mean that when they believe they are ready to cut rates it will likely happen swiftly. For now, the Reserve Bank should keep rates on hold for the remainder of the year or, dare it said, increase rates if there are any signs of higher inflation.

- High Yield corporate debt does not appear to provide sufficient return for the risk, and we believe there are better places to achieve higher risk-adjusted returns, so for now our fixed interest preference remains higher quality investment grade debt. With Cash rates yielding higher than bonds, cash continues to appeal and remains the fixed interest king.

- Finally, investing with styles that favour value, quality (whether bonds or equities) appears appropriate but no matter the preferred market, portfolio diversification is crucial.

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning Pty Ltd is a Corporate Authorised Representative of MCS Financial Planning Pty Ltd | ABN 11 677 710 600 | AFSL 560040