Market Snapshot: May 2025

Summary

High debt levels and Tariffs are the new risk combination …

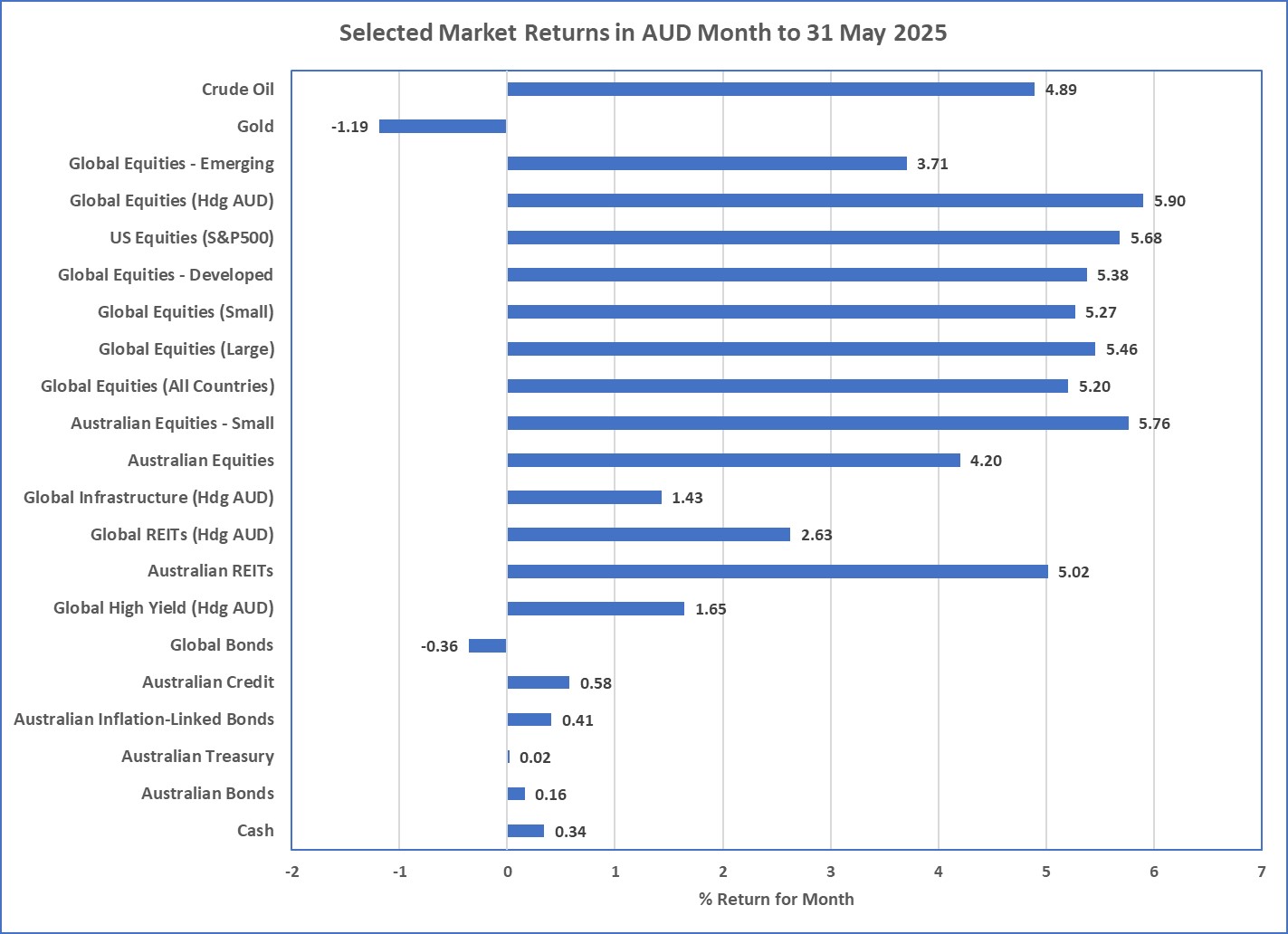

- Most markets have looked through the global economic turmoil to produce strong monthly returns from around 3.5% to a little under 6% across the major risky asset classes including Australian Shares, Emerging Markets, US Shares, Global Shares, and Australian REITs.

- The weakest performance came from a slight pullback from the strong returner of recent times, Gold. Gold has been the hedge to potential chaos so a risk-on month means a slight pullback from Gold after a 40%+ 12 months should be unsurprising.

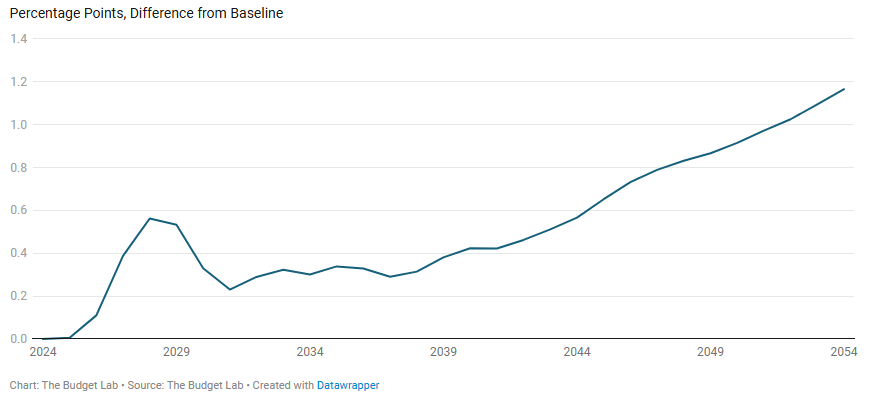

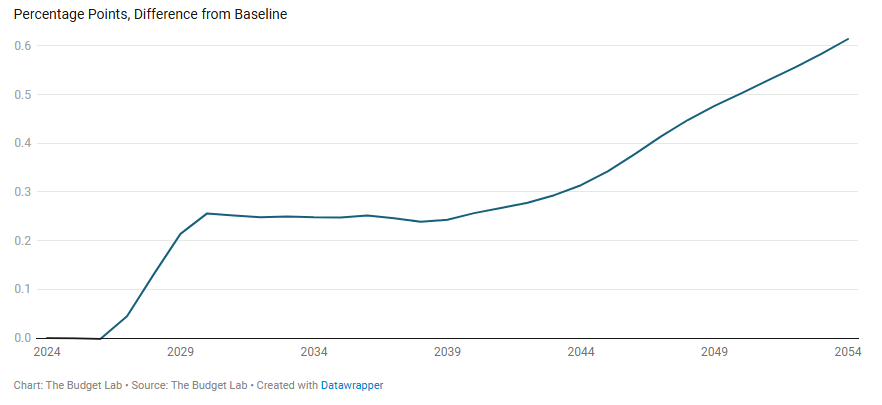

- Global Bonds were also negative following the announcement and lower house passing of the USA’s budget reconciliation bill which is forecasting a very large budget deficit that will substantially increase US government interest costs (hence higher yields and weak prices).

- The Reserve Bank reduced its Cash rate in May by 25bps to 3.8% and is forecast to drop by another 25bps in July. Current markets price in the RBA Cash rate to around 3% by the end of 2025 so increased monetary stimulus in coming to assist the Australian economy that produced a low 0.2% real growth in the March quarter of this year.

- Our expectations are for sharemarket volatility as change is happening quickly, and the global economy appears to be adjusting. Weaker global economic data is likely for the second half of 2025.

- Our core investment message today is to maintain diversification with focus on the long term. Major risks continue to lie with expensive sharemarkets, including large companies of the USA, and we continue to favour quality (i.e. good profitability) and value (i.e. “cheap”) styles for long term investments in shares. Quality bonds are preferred as higher yielding below-investment grade bonds provide a historically low premium.

Chart 1 … What tariffs? … Risk is back on

Source: Morningstar

What happened last month?

Markets & Economy

- Whilst tariffs are still the economic and market influencer du jour, markets seemed to brush off the constant changes and bounced significantly during May. In Australian dollar terms, most growth asset classes returned strongly between 3% and 6% for the month and this included Global Shares (MSCI World), US Shares, Australian shares, Australian REITs, and Emerging Markets.

-

The only negative asset class returns came from Gold and Global Bonds. Gold has been behaving the opposite of shares in recent

times behaving more like a hedge for chaos, whilst Global Bonds suffered because of higher US Government Bond yields. These higher

yields followed the One Big Beautiful Bill announcement … a budget reconciliation bill that passed the House of Representatives on 22

May.

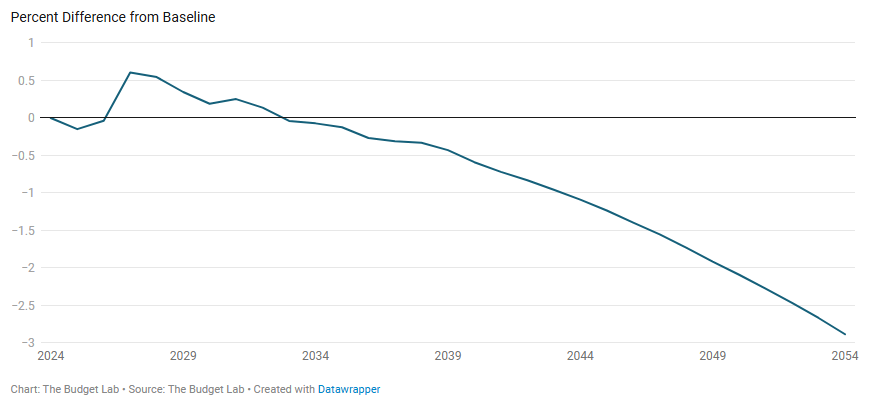

- If it passes the Senate, this Bill appears likely to significantly increase USA's debt levels adding significantly to its future interest costs, increasing concerns about future USA economic growth as interest costs ultimately dominate future budgets.

-

Between tariffs and increased debt levels, the US dollar did not strengthen alongside the higher bond yields like it usually has in recent

years. This was another potential long term economic risk as a weaker dollar also reduces the potential of paying off higher debt levels.

- High debt levels plus high tariffs are the new risk combination.

- High debt levels plus high tariffs are the new risk combination.

- From a US economic perspective, the expected weaker economic data from tariffs has not yet materialised as inflation stays low (2.3%) as does unemployment (4.2%), but then most economic weakness is expected for the second half of 2025.

- In Australia the Reserve Bank reduced its interest rates another 25bps to 3.8%, markets are expecting another 25bps cut in July, and they also are pricing cash rates at around 3.1% by the end of 2025.

- Australian inflation is generally accepted as back to normal and the lower cash rates will provide some support for a relatively weak Australian economy which only produced 0.2% real economic growth in the March quarter of this year.

Outlook …no change … continued Volatility most likely

- With sharemarkets near highs again, the USA market continues to be priced for very high growth despite the previously mentioned risks. For the USA tariffs will bring higher inflation and the word stagnation (meaning stagnant economy and high inflation) will likely be frequently aired. As a result, high inflation from tariffs will likely mean the Federal Reserve, still avoids rate cuts and US interest rates may stay or potentially increase. Either way, volatility across both bond and share markets is expected for 2025.

- Sharemarkets in Australia and the non-USA rest of the world are priced a little better than the USA but higher than usual volatility is still expected as global trade uncertainty persists. Higher tariffs are still expected to slow global economic growth meaning lower rates of spending than previously expected.

- Overall, the general portfolio preferences are unchanged and centres on diversification. Volatile markets are likely to continue, and diversification continues to be essential in this environment, whether shares, bonds, real assets, as well as across regions and broader asset class levels. Over the long-term, we believe valuation matters and this continues to be another central theme for investment today.

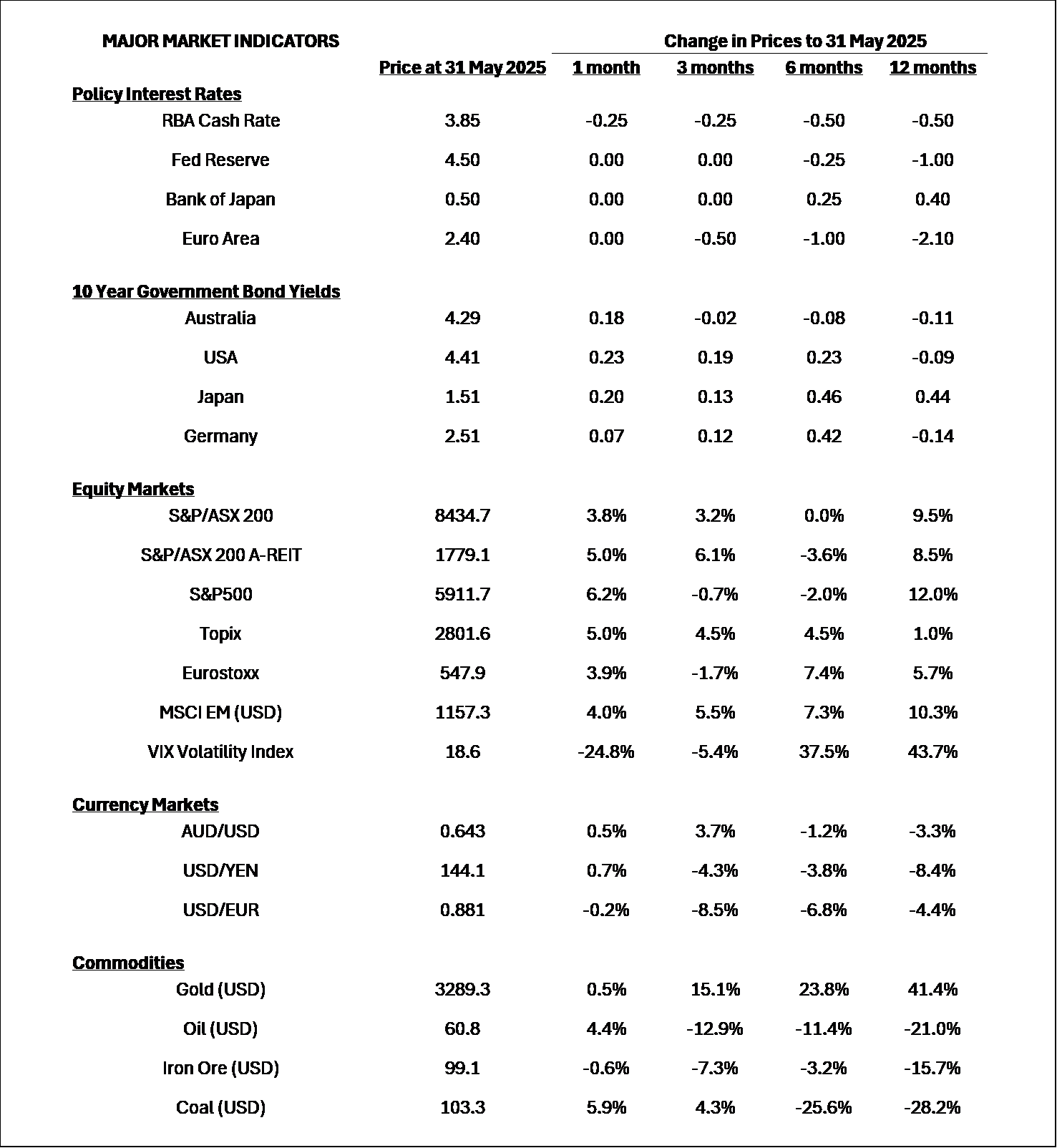

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

Change in Real GDP from the One Big Beautiful Bill (OBBB)

Expected Impact on 10-year Treasury Yield by OBBB

Effective Interest Rate of Federal Debt from OBBB

McConachie Stedman Financial Planning Pty Ltd is a Corporate Authorised Representative of MCS Financial Planning Pty Ltd | ABN 11 677 710

600 | AFSL 560040

General Advice Warning

The information provided in this article is for general information purposes only and is not intended to and does not constitute formal

taxation, financial or accounting advice. McConachie Stedman does not give any guarantee, warranty or make any representation that the

information is fit for a particular purpose. As such, you should not make any investment or other financial decision in reliance upon the

information set out in this correspondence and should seek professional advice on the financial, legal and taxation implications before

making any such decisions.