Market Snapshot: November 2022

In summary

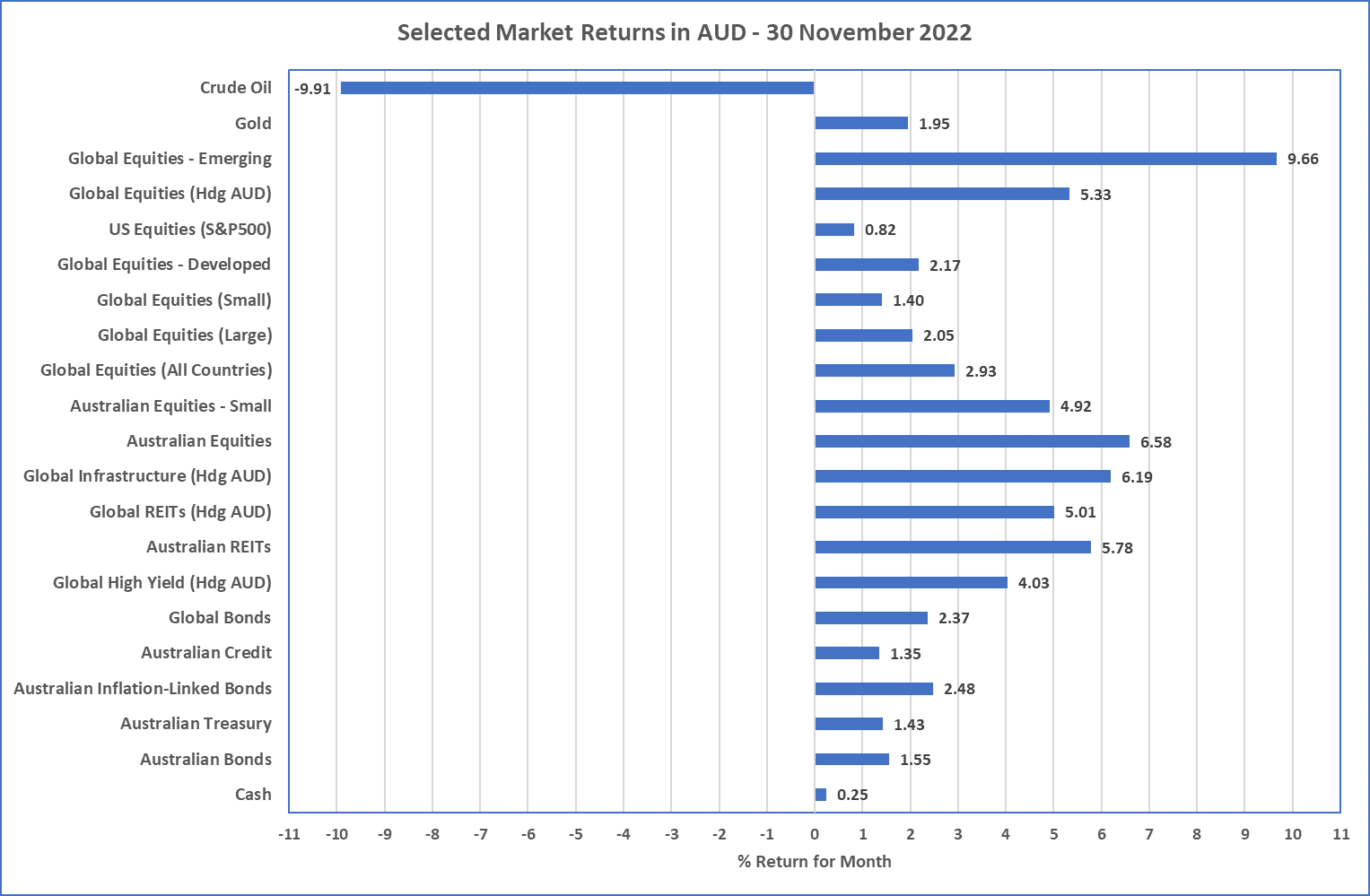

An excellent month for investment returns

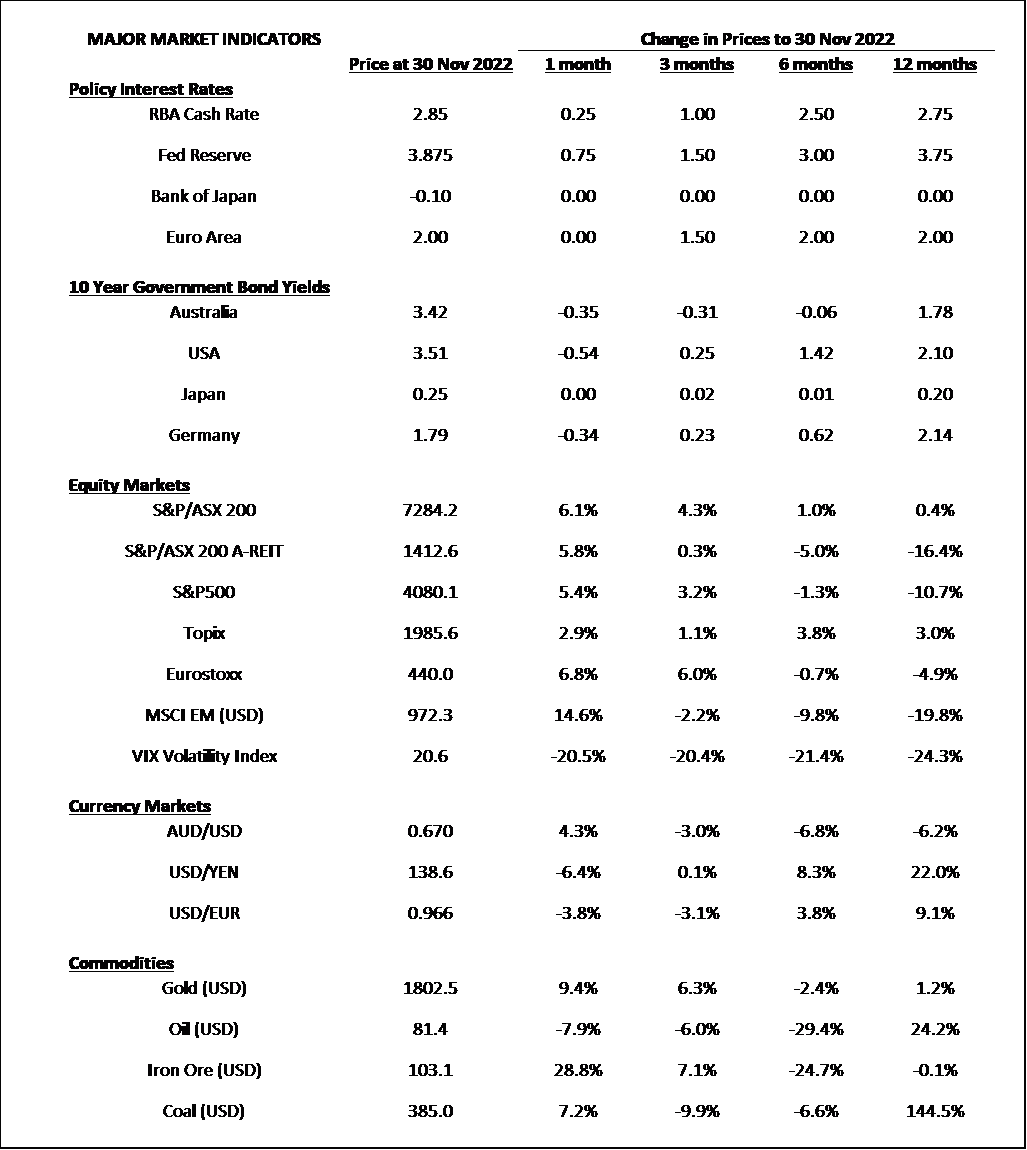

- Cash rates around the world continue to increase as central banks continue their fight against inflation. There are signs of lower inflation as energy and food prices continue their downward trend, but the Russian war in Ukraine continues, and wage inflation in the USA continues to be high.

- Investment markets had another strong month in November and this time every major investment asset class outperformed Cash (except Oil which declined almost 10% in Australian Dollars)

-

Looking ahead, our expectations are unchanged from previous months. That is, investment market volatility will increase across all

asset classes as the global economy slows down into 2023. This slow down is inevitable whilst central banks implement the fastest and

sharpest tightening of monetary policy the world has seen for many decades.

- From a valuation perspective, we prefer underweight positions in the most expensive markets which includes US Equities and High Yield.

- Other preferences include high quality securities which are defined by good profitability and strong balance sheets.

Chart 1: Hiding in Gold

Sources: Morningstar

What happened October?

Markets & Economy

Short term positive momentum persists

- The positive results from markets in October continued even more strongly in November and particular for the Australian sharemarket which one of the better performing asset classes returning over 6.6% (S&P/ASX 200).

- Despite continued economic concerns about China’s zero-COVID policy, Emerging Markets (MSCI EM) was the strongest performing asset class returning almost 10% for November, whilst Developed Markets (MSCI World) produced 2.2% and was largely lower due to a strong Australian dollar which strengthened against the US Dollar by 4.3%.

- This short-term positivity around the sharemarkets was largely aided by some lower than expected inflation results out of the USA (7.7% for Oct vs 9.1% peak inflation in June), and expectations that the Federal Reserve (& other Central Banks) may start to increase rates more slowly than previously expected. Aiding lower inflation expectations included lower Oil Prices (down almost 10% for November) and some food-related prices (e.g. Wheat prices declined from $900 USD/Bu to $750 USD/Bu during November).

- Central banks continued their cash rate increases. The Reserve Bank increased another 25bps in the first week of December and current cash rates are 3.1% (the highest for almost 10 years). Meanwhile the Federal Reserve Bank increased by 75bps during November and expects to slow their hikes to 50bps in December … this growth reduction providing fuel for the belief inflation may be behind us … however, there is a long way to go yet.

- Australia’s GDP for the September quarter was released on the first Wednesday in December and it showed growth of 0.6% which was higher than 12 months ago, but lower than the previous 3 quarters so is showing some early signs of a slowing economy.

Outlook

Sharemarket volatility coming back

- Whilst investment returns were strong in November, there are still numerous signs pointing to a recession in USA and Europe in 2023. Namely, negative sloping yield curves in USA, UK, and Germany. This means longer term bond yields are lower than shorter term yields and this is generally a good predictor of future recessions.

- It is not uncommon for sharemarket rallies before recessions, so the last two months of strong performance does not mean the tough times are behind us. The re-emergence of sharemarket volatility should be expected. That said, it doesn’t mean sharemarkets will decline, as volatile markets can be up or down … but there are many mixed messages likely to make sharemarkets jumpy.

- Bond Yields have generally dropped across the developed world, including Australia, and whilst this was good for short term returns, it means the expected return outlook for bonds has reduced and they are not quite as appealing as last month.

- Finally, high yield investments are only providing a small premium over government bonds, and this difference does not appear strong enough to provide confidence for allocating more funds there (yet).

- Our current investment preference continues to be higher quality (whether profitability or low leverage) and value-style (i.e. cheaper than market securities) securities to provide a cushion as interest rates continue to increase.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619