Market Snapshot: October 2021

In summary

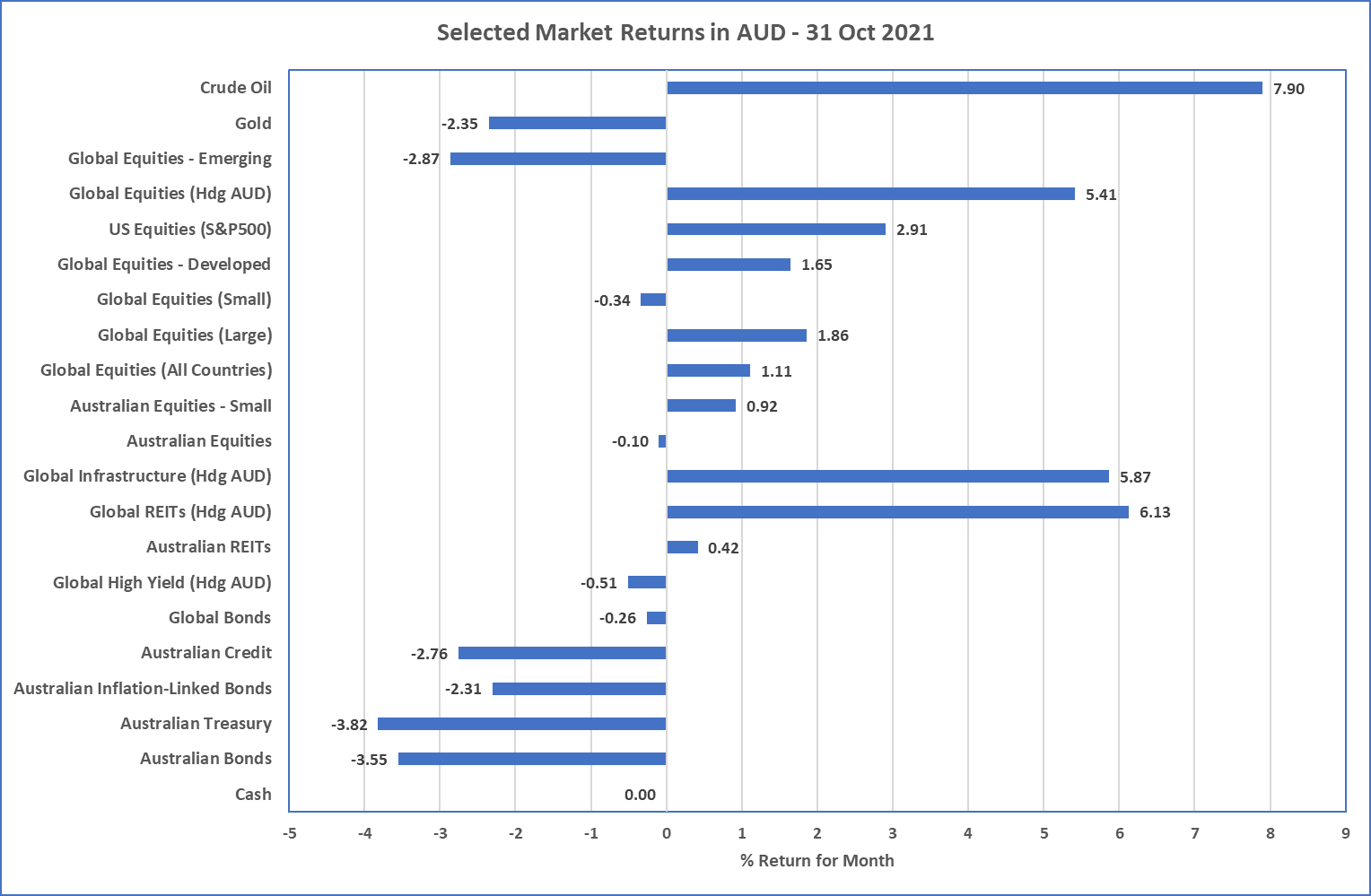

- Higher bond yields in the last week of October resulted in negative bond returns which were only partially offset by positive equity returns driven by Real Assets (Property and Infrastructure) and US equity markets.

- A stronger Australian dollar also meant unhedged global asset returns were slightly reduced. This strong dollar was driven by the higher Australian bond yields and in spite of the 11% drop in Iron Ore prices (which are down around 60% from its highs earlier in the year).

- Higher inflation expectations have been driven by global supply chain problems which include staff shortages in transport and higher shipping costs. Of course the pandemic is the major catalyst for all of this continuing this unusual global economic climate.

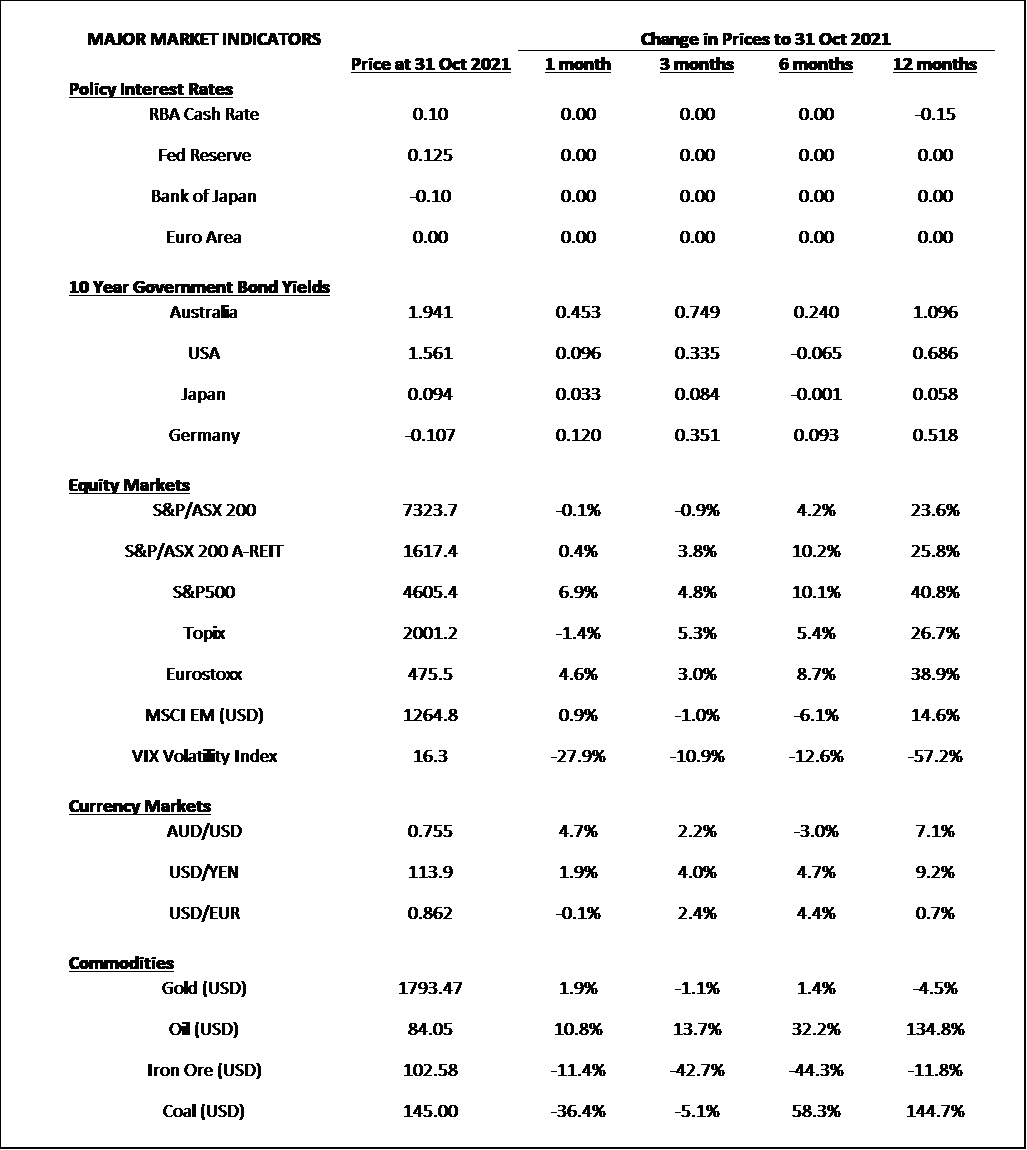

- Related to higher inflation is also the higher input costs that are coming from high energy prices such as Oil (highest since 2014) and Coal (at or near record highs and up over 100% in the last 12 months).

- Looking forward, inflation will be a major focus as it feeds into Central Bank decisions and US Equity markets continuing concerns around their near record valuations (irrespective which valuation measure is considered).

- Single digit returns are expected for all “Balanced” portfolios over the next 5+ years.

Chart 1: The effects of a stronger Australian Bond Yields and AUD

Sources: Morningstar Direct

What happened in October?

Pandemic

NSW and Victoria open

- With double vaccination rates over 80%, NSW and Victoria have taken large steps before completely opening their respective economies. Privileges of a normal life are near but limited to the double vaccinated only. Either way, this should increase the speed of the remaining unvaccinated lining up for their vaccinations.

- Around the world, COVID-19 related death rates have increased in Russia, Ukraine and some of Eastern Europe including Romania, and Bulgaria. A new deadly variant will continue to be a major economic risk.

- Double vaccination is currently under 40% for the world population so is a long way from any reasonable levels of herd immunity. Australia currently sits on ~65% of double vaccination of its population.

Markets

Bond Yields up … so prices are down

-

In the last week of October, the Reserve Bank ceased some of their bond purchasing program meaning this reduced demand for bonds resulted

in bond yields increasing. Australian 2-year bonds went from a yield of 0.15% on 26 October to finish the month yielding 0.69% and 3-year

bonds went from 0.69% to 1.17% … both significant and rare.

- Overall, the Australian Bond yield curve increased around 0.40%, which contributed to a decrease in Australian Bond market returns of around 3.5% (see Chart 1).

- This is consistent to many pundits expecting sustainable and higher inflation. The Reserve Bank has countered this view suggesting inflation should be within their target range and unlikely to be sustainably higher over 2022 and 2023.

- Globally, supply chain problems (e.g. no truck drivers in UK; higher shipping costs) and higher energy prices (see Oil and Coal prices at Major Market Indicators), have contributed to higher inflation expectations and also higher bond yields. Central banks, including the US Federal Reserve, have also continued their rhetoric that inflation is most likely short-term and will likely revert to lower levels as the effects of the pandemic recedes.

-

Equity markets were mixed for October with the already expensive US Market recommencing its momentum and returning a very high

6.9%.

- Emerging Market and Australian equity markets were flat.

- The Australian dollar strengthened during October reducing unhedged global equity returns. This strength was counter to the massive price decline of Australia’s biggest export, Iron Ore. Iron Ore prices reduced 11% and are priced around $100 down from its ~$220 2021 peak.

Economies

Nothing too new

- Inflation figures are currently high, but this is expected. Recent results show USA at 5.4%, Europe at 4.1%, and UK at 3.1%, all well above long term trends. On the flipside of these results are the large emerging markets where China’s inflation is at 0.7% and India’s at 4.3% (which is its lowest for a while and not too different from the last 5 years).

- September quarter economic growth numbers are not available for major developed countries, but China showed a decline in its growth rate with a somewhat weak 4.9% result.

Outlook

- Markets are currently very sensitive to economic results as inflation continues to be the topic du jour. Strong economic results, whether inflation, unemployment, or growth itself, will likely result in increased bond yields and the opposite is likely true too. Central Banks and markets have kept rates still at historically low levels so there is a general consensus that high inflation will not be sustained but we won’t know for some time yet.

- With high valuations and uncertain inflation outlook, we are maintaining strong levels of diversification in portfolios as the major risk mitigator, and equity strategies and bond holdings continue as defensive hedges to potential market volatility.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619