Market Snapshot: October 2022

In summary

A reversal of trend but don’t be fooled

- Central banks continue to raise rates and quickly. Over the last month, the Federal Reserve increased its cash rate by another 75bps, so too did the European Central Bank, whilst the Reserve Bank increased by 25bps. This leaves major economy cash rates around the world at 4% in the USA, 2% in the Euro area, 3% in UK, and 2.85% in Australia, and this momentum will likely continue.

-

The determination of the Central Banks of the world to increase rates to combat inflation comes at the short-term cost of the economy which

also means that financial markets will experience above average volatility for some time yet.

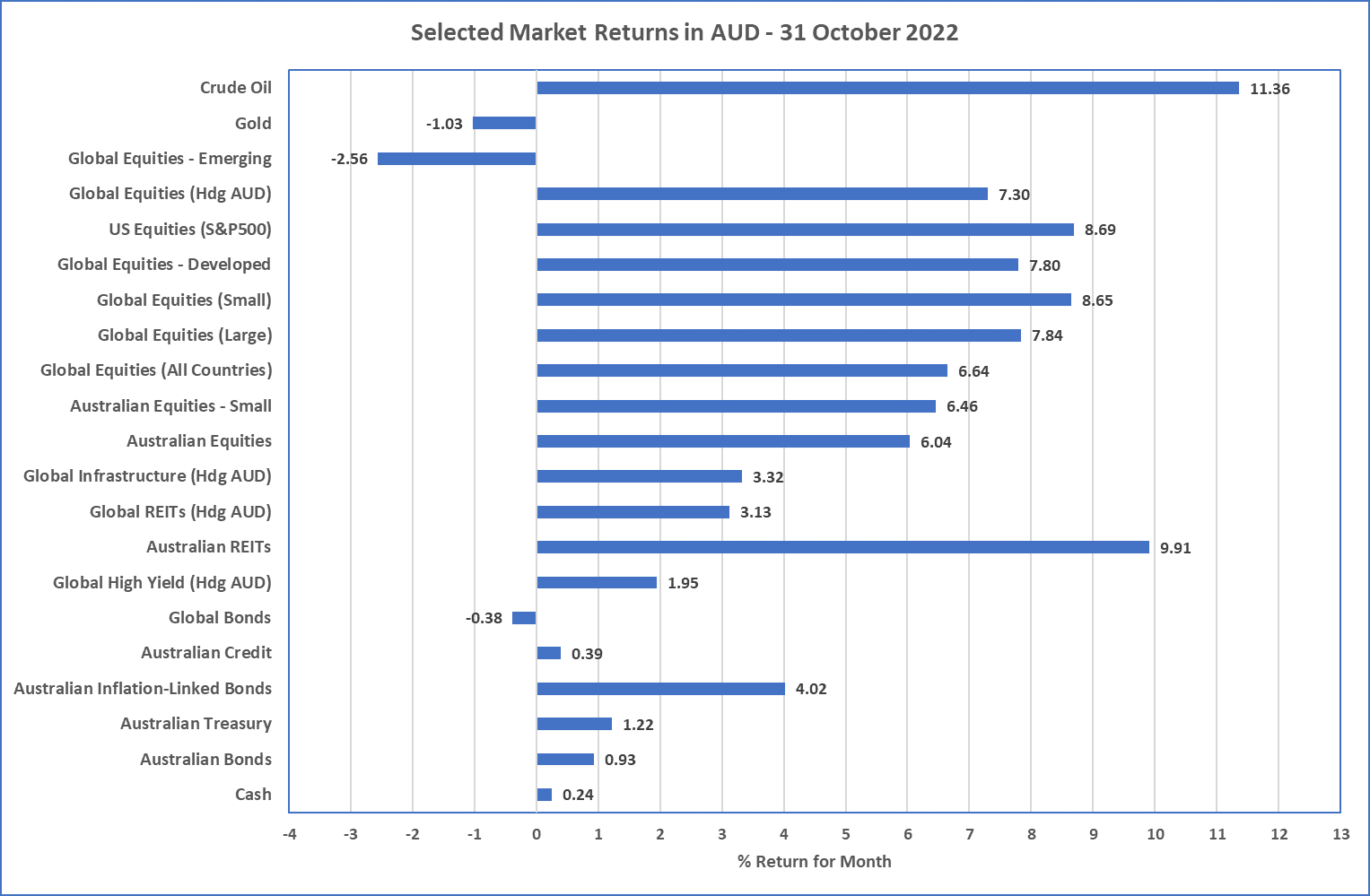

- That said, most markets bounced back a little in October which follows some poor returns during July and August. As Chart 1 shows, only Gold and Emerging markets reduced by more than 1% whilst Global Bonds were down slightly (-0.4%).

-

Right now, it is likely that Europe is in recession and looking ahead it appears USA may enter recession some time in 2023. This means that

financial markets will continue to be very challenging to navigate. If inflation outlook improves there could be sharp sharemarket price

rises and if not, higher interest rates may put downward pressure on valuations. Either way, market timing will be very difficult, so

diversification of portfolios is important.

- From a valuation perspective, we prefer underweight positions in the most expensive markets which include US Equities and High Yield.

Chart 1: Hiding in Gold

Sources: Morningstar

What happened in October

Markets & Economy

A sharp bounce-back by risky assets but high inflation persists

- With the exception of Emerging Markets (thanks to China being out of favour), almost all risky assets, whether equities, property or infrastructure, bounced back with very high returns over the month of October. That said, it was a month of two halves as the start of October was very volatile and most markets were sold off.

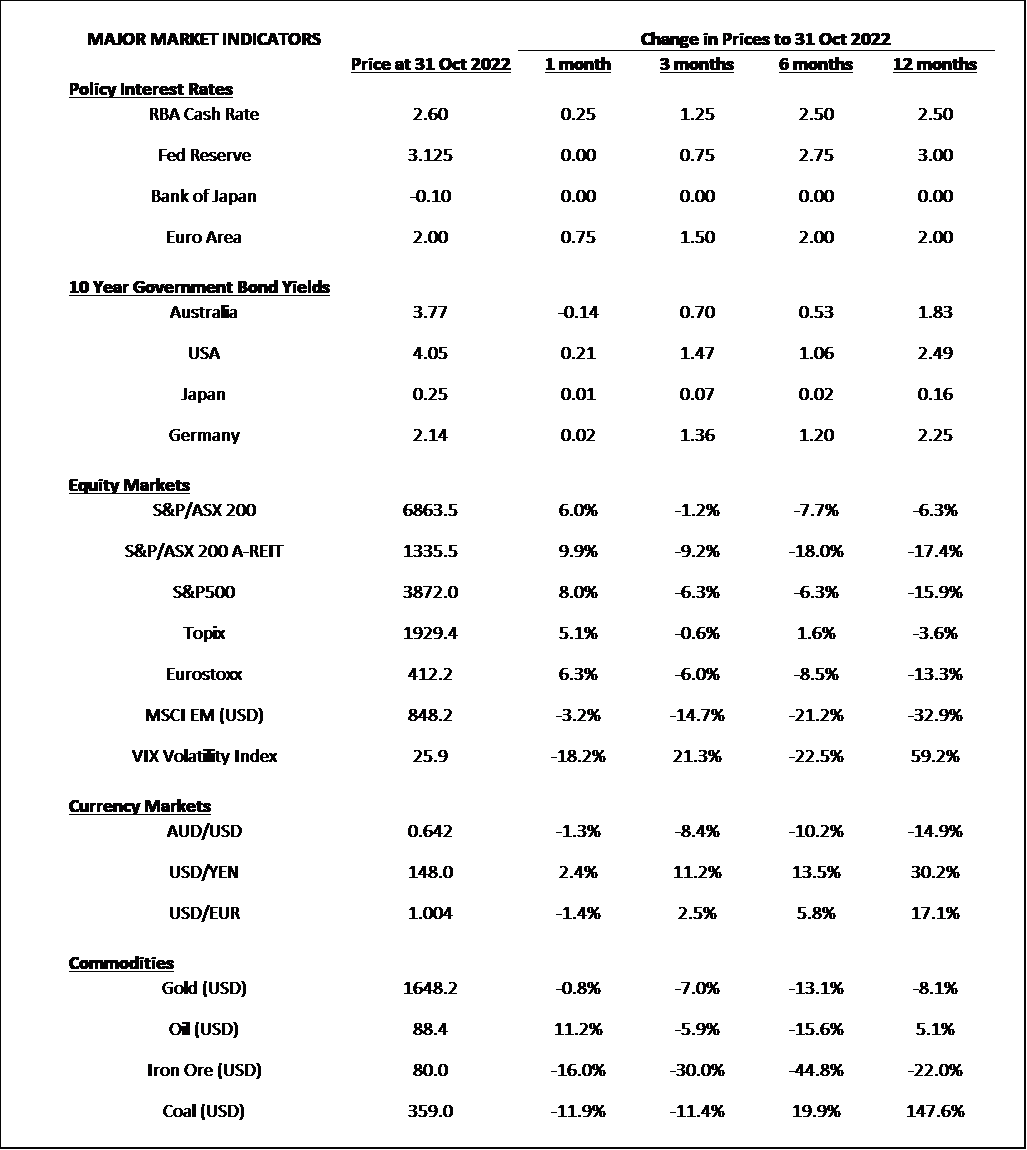

- The bond markets generally ended the month flat as bond yields didn’t change a great deal from the end of September to end of October. An interesting observation is over the last 6 months, the Australian 10-year bond yield has reached 4.1% three times and then dropped at least 0.5% … this suggests that 4.1% yield is the market’s ceiling and a potential buying opportunity.

- Despite the strong October performance in most financial markets, inflation is still raging as Europe continues over 10% thanks to high energy and food prices from the Russian invasion of Ukraine. USA’s inflation continues over 8% and is accompanied by high wage inflation. Australia’s inflation is also getting close to USA’s registering 7.3% inflation in the 12 months to end of September.

- In terms of economic growth, Economists currently believe Europe is currently in recession and USA is on the way and likely to be in recession in 2023. There are numerous leading indicators, from new housing starts to CEO confidence to the bond yield curve, that all suggest recession is highly likely in 2023 and exacerbated by the Federal Reserve’s determination to combat inflation at the cost of the short-term economy. However, whilst USA has strong levels of employment and relatively high wage inflation recession will not be declared.

- Thanks to our commodity driven economy, Australia is better positioned economically, but if high inflation persists and the Reserve Bank’s current stance of more rate increases also persists, then the Australian economy will weaken substantially too.

Outlook

Whilst central banks are increasing cash rates, equities will be volatile

- The headline of this outlook is unchanged from last month. The sharply rising cash rates by the central banks of the world, and in particular the Federal Reserve, means there is more equity market volatility coming and investors should buckle up for a continued wild ride.

- It is difficult to know whether bonds will be supportive to equity market volatility or increase in yield alongside of cash rates. It is generally unusual for bond yields to increase in the face of recession but that is what’s happened so far. If inflation continues to increase or stays high then bond yields may increase thereby adding to the volatility of portfolios. Caution is warranted and we prefer allocations to cash-like securities, including floating rate notes.

- From a valuation perspective, the USA equity and high yield markets do not currently reflect recession risks, so are contrary to many other leading indicators so we remain cautious and underweight across these markets.

- Whilst markets have performed well over October we maintain our cautious positioning across portfolios and stress diversification over concentrated positions. Our concern over volatility suggests an underweight position to risky assets but we must also caution against being out of the sharemarket because it appears they could surprise on the upside very quickly should Russia exit Ukraine or the inflation levels start to drop quickly.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619