Market Snapshot: October 2025

Summary

Mixed economic outlook vs expensive sharemarkets

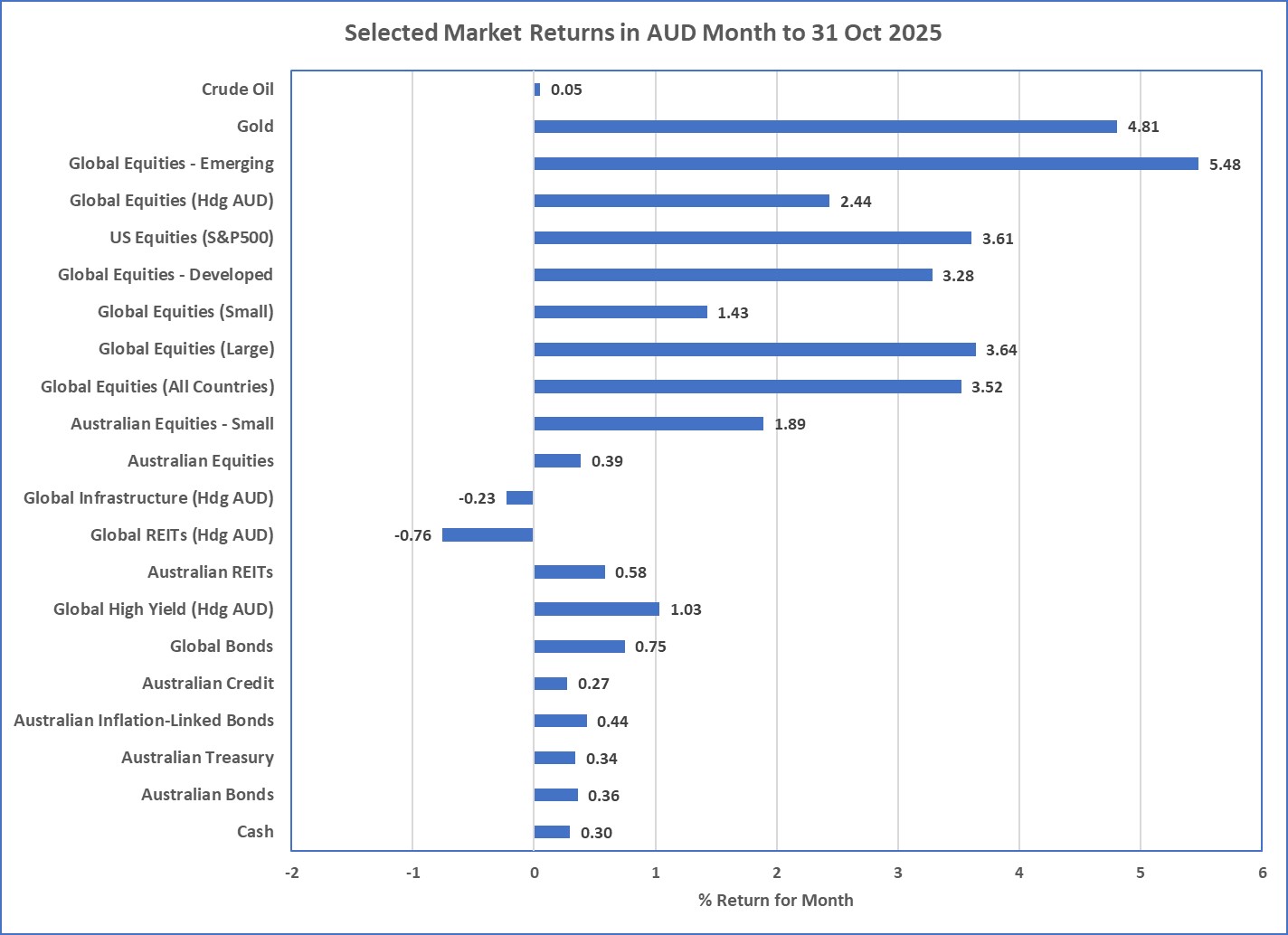

- Global sharemarkets continued their strong momentum thanks to continued Artificial Intelligence capital expenditure which is also responsible for most USA economic growth.

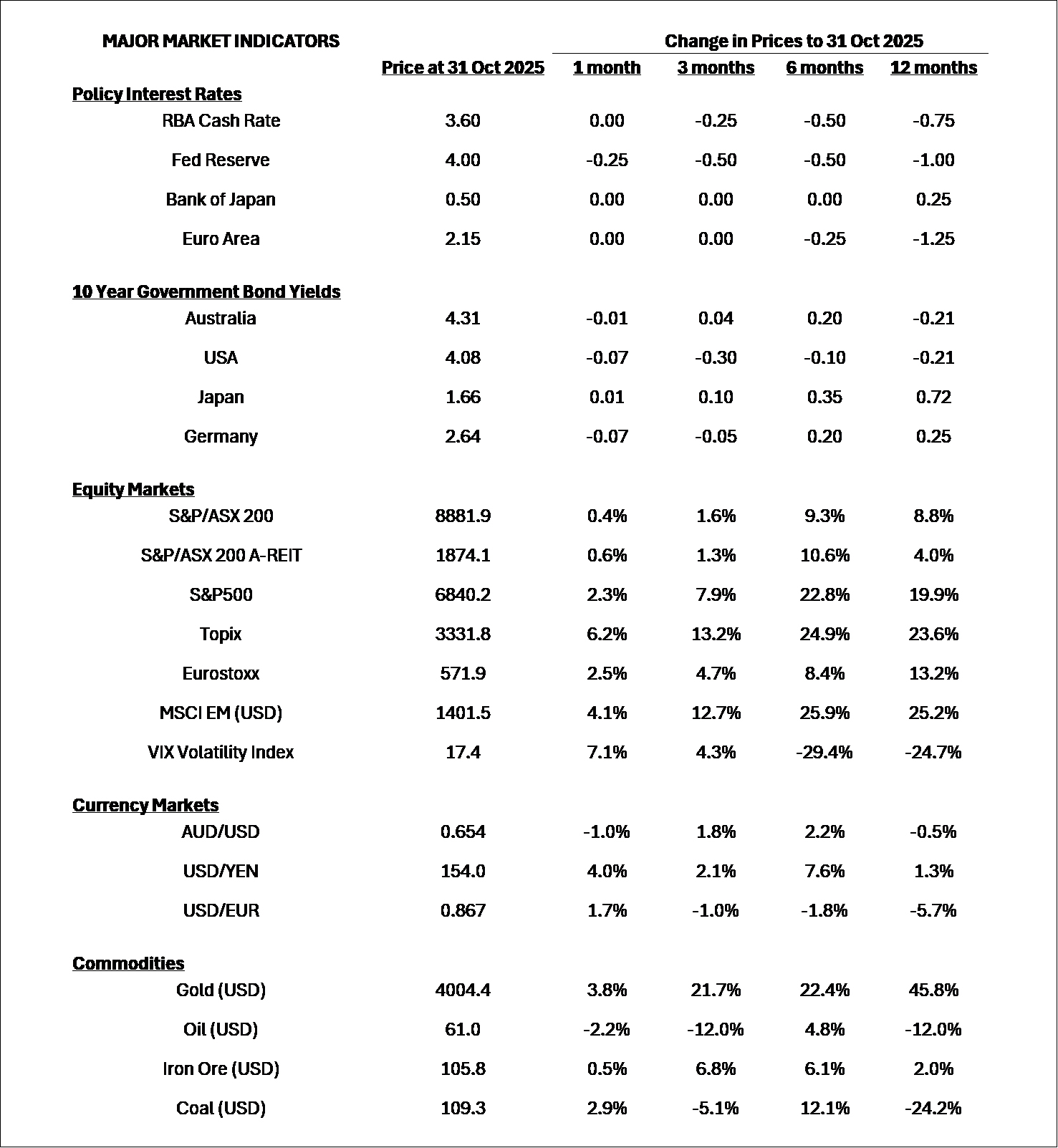

- Australia’s Reserve Bank kept its cash rates at 3.6% as inflation increased and now has a headline rate of 3.2%, which is a little higher than their 2-3% target. Bond yields were relatively steady in Australia and around the world, producing small but positive returns.

- USA also has high inflation but this contrasts with the continued weak employment market and the IMF has forecast continued subdues global economic growth due to continued trade tensions.

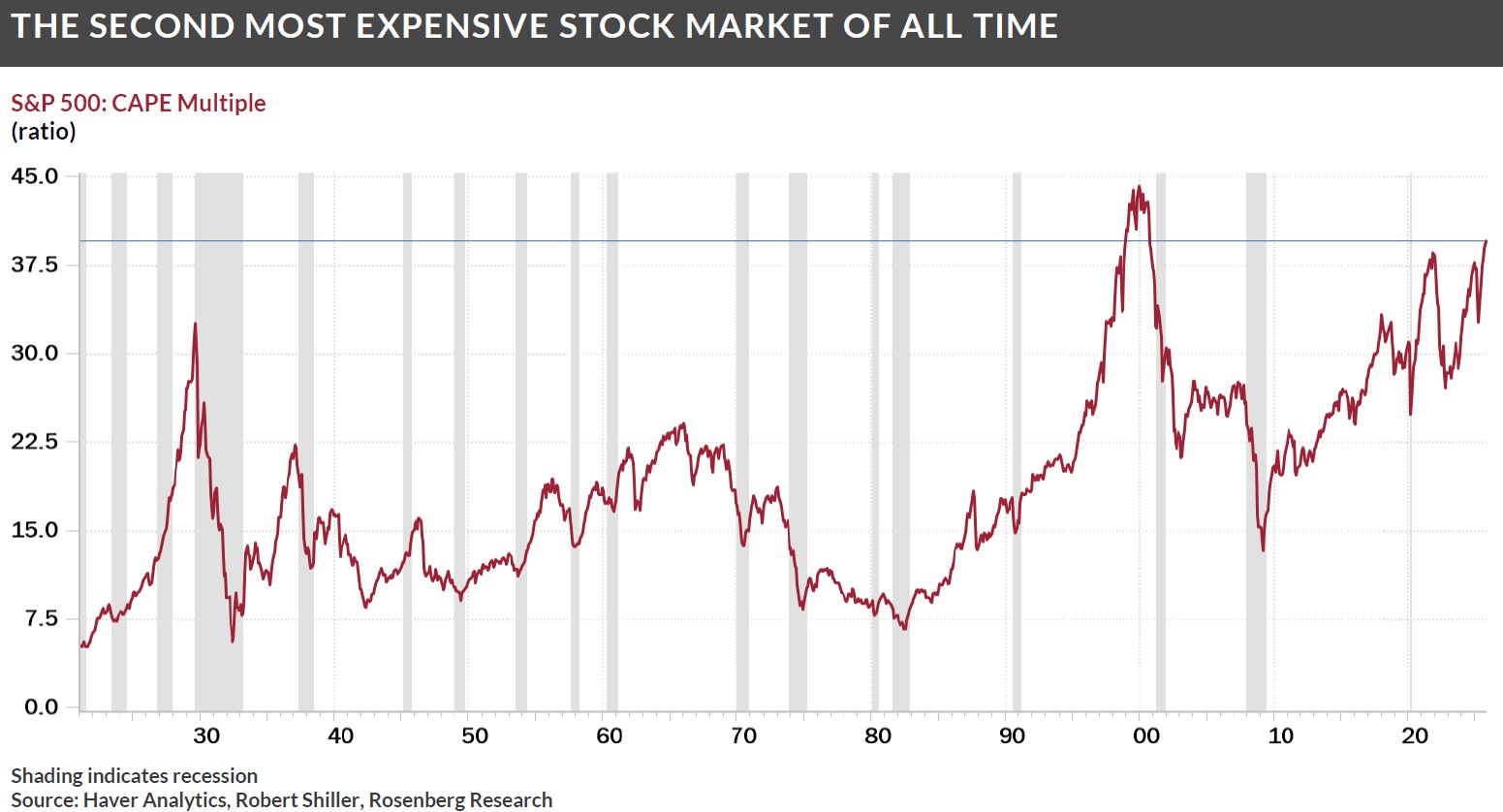

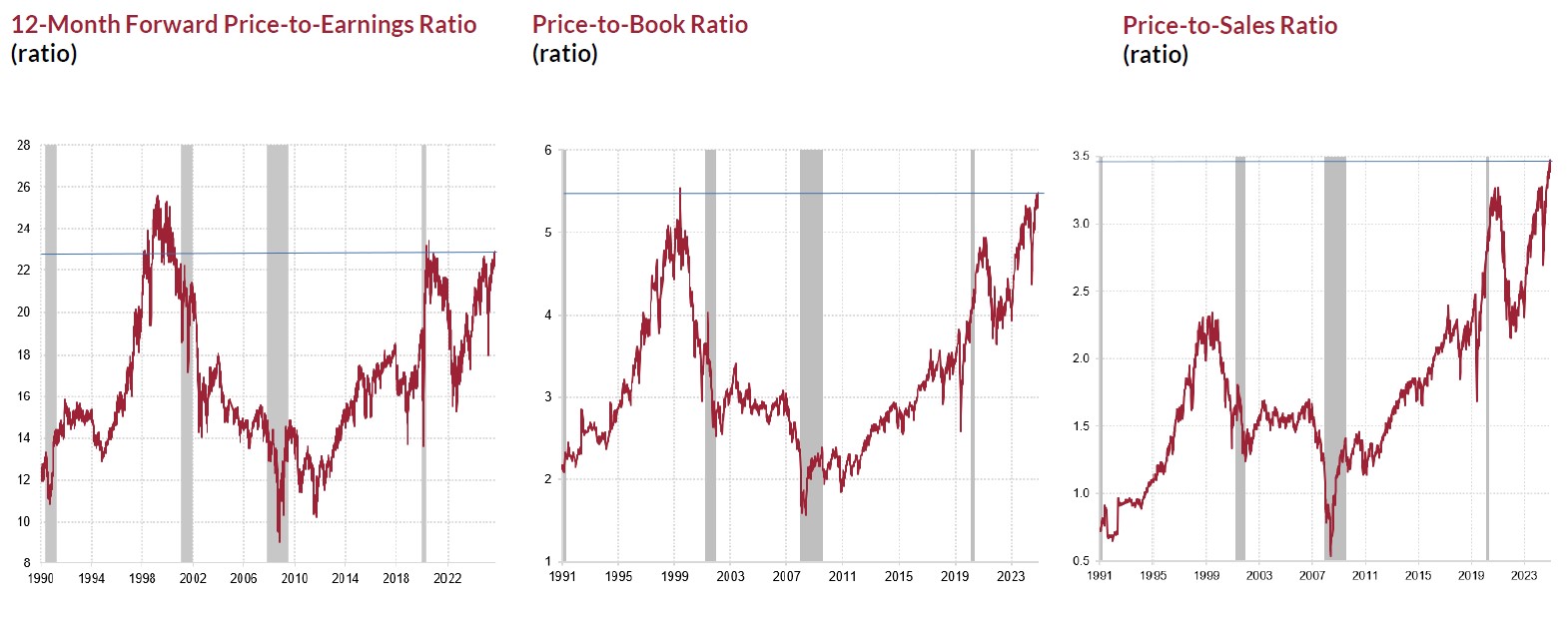

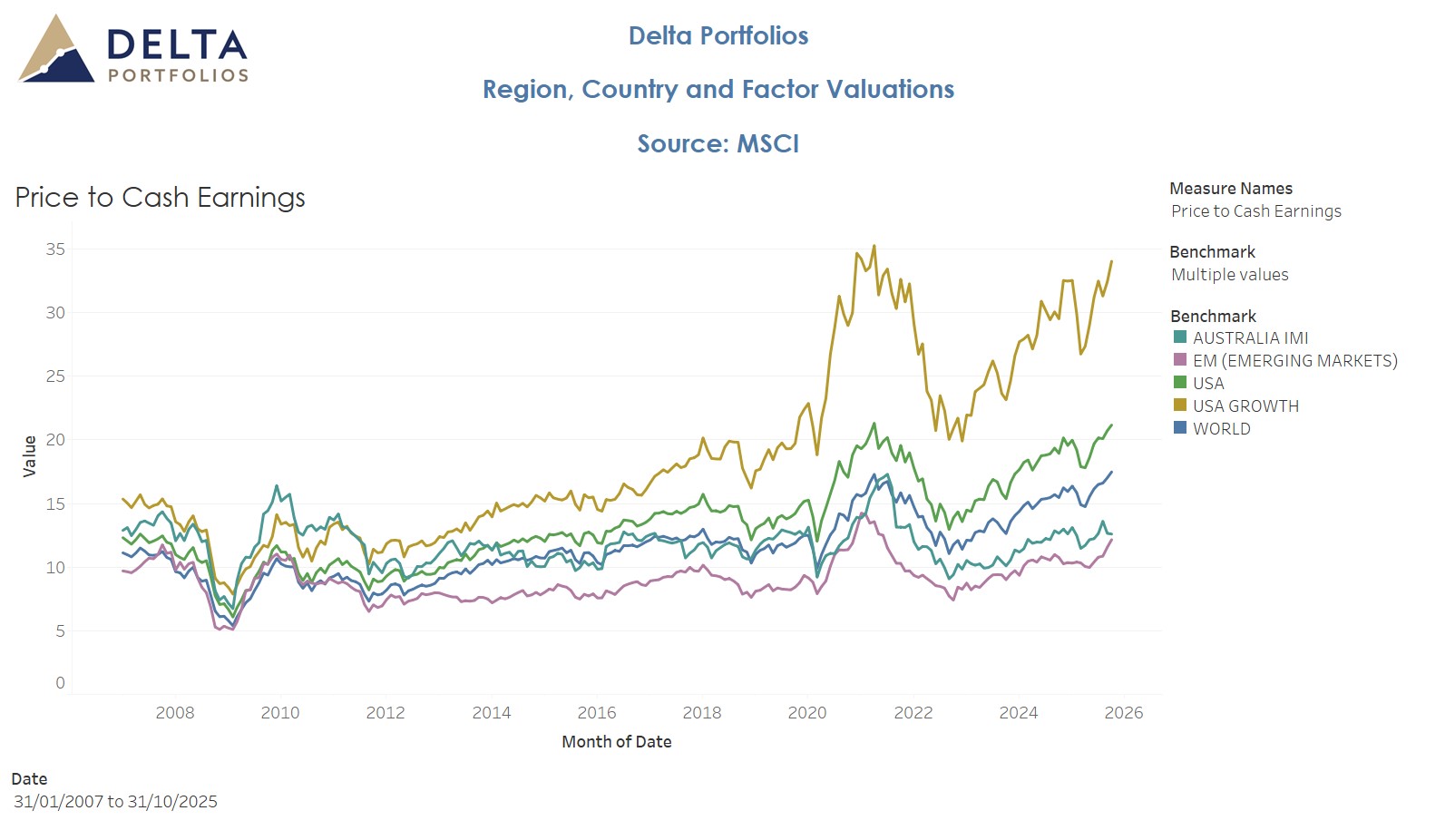

- In the first week of November the USA sharemarket is displaying high volatility which has been expected considering USA sharemarket valuations continue amongst the highest this century. This is influencing a long-term bearish outlook for many investors.

- Our core investment message today is to maintain diversification, focus on the long term, and regularly rebalance. Major risks continue to lie with expensive sharemarkets (irrespective of artificial intelligence confidence and the prospect of illegal tariffs), including large companies of the USA, and we continue to favour quality (i.e. good profitability) and value (i.e. “cheap”) styles for long term investments in shares. Quality bonds are preferred as higher yielding below-investment grade bonds provide a historically low premium.

Chart 1 … Global sharemarket momentum continues

Source: Morningstar

What happened last month?

Markets & Economy … strong markets but mixed economic outcomes

- In the USA employment remains weak and was the main reason behind their 25bps cash rate reduction down to 4%. However, further rate cuts in the short term appear unlikely as inflation ended up a little higher than expected. Higher than expected inflation was also the case in Australia also resulting in reduced expectations of Australian cash rate reductions.

- The IMF has continued to predict subdued global economic growth and, unsurprisingly, due to the weaker trade off the back of renewed higher tariffs imposed by the USA.

- Overall, global economic conditions appear mixed and lacking clear direction. Despite this, global sharemarkets, including Emerging Markets, continued their strong positive momentum producing above-average returns. Much of this relates to the Artificial Intelligence boom which is also resulting in 1999-like sharemarket valuations that are likely unsustainable unless earnings growth is above long-run averages.

Outlook …US Sharemarket valuations remain the concern

- Attempting to rewrite this section to produce a different outcome than previous months appears redundant as nothing of significance has changed the general position and outlook. Artificial Intelligence continues its boom, and valuations continue to be stretched for risky markets like shares, and high yield.

- Strong sharemarkets keep the US Sharemarket at high valuations. As reported the last two months, they are either heading towards the pre-correction 2021 levels or are near the highest valuations this century. Other markets, including Australia appear fully valued, although Europe, Japan and Emerging Markets appear somewhat fairly valued.

- Whilst US employment data has shown weakness, inflation is higher than desired, artificial Intelligence capital expenditure continues as the growth engine for now.

- Whist inflation in Australia reduced to 2.1% in the June quarter, the September quarter’s result was a headline 3.2%. Current pricing suggests the Reserve Bank of Australia will probably only produce one more 25bps rate cut over the next 6-9 months as economic data has been stronger than previously expected. Mixed economic outcomes create uncertainty around the direction of cash rates in USA and Australia and are generally expected to be steady.

- Overall, the general portfolio preferences are unchanged and centres on diversification. Volatile markets are likely to continue, and diversification continues to be essential in this environment, whether shares, bonds, real assets, as well as across regions and broader asset class levels. Over the long-term, we believe valuation matters and this continues to be another central theme for investment today.

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

Source: Rosenberg Research

Source: Delta Research and Advisory, MSCI

McConachie Stedman Financial Planning Pty Ltd is a Corporate Authorised Representative of MCS Financial Planning Pty Ltd | ABN 11 677 710

600 | AFSL 560040

General Advice Warning

The information provided in this article is for general information purposes only and is not intended to and does not constitute formal

taxation, financial or accounting advice. McConachie Stedman does not give any guarantee, warranty or make any representation that the

information is fit for a particular purpose. As such, you should not make any investment or other financial decision in reliance upon the

information set out in this correspondence and should seek professional advice on the financial, legal and taxation implications before

making any such decisions