Market Snapshot: September 2022

In summary

A bit like August

- Central banks continue their hawkish approach increasing cash rates with the primary goal of reducing inflation but at the potential cost of the global economy.

- All major asset classes, except Cash and Gold, produced negative returns in September as rising cash rates challenged valuation levels and a weaker economic outlook reduced growth forecasts.

- The US Dollar strengthened further and with the Australian dollar around $0.65USD it is starting to present a stronger case for hedging global equities.

- Looking ahead the current market volatility is likely to continue for a few months yet. This is despite some inflation reducing factors like lower commodity prices, but global supply problems continue, and many expect inflation to stay high meaning central banks aren’t stopping their rate increases yet.

-

Whilst the short-term performance for all asset classes is challenging for even the most resilient investor, the most important investment

principles today are to focus on the long-term and diversify.

- Valuations across most asset classes are no longer high and long-term expected returns are above inflation expectations. The long-term outlook for investing is good.

- Investment diversification is essential today as increased recession risks are the requirement to produce unexpected company problems and diversification reduces this risk of being caught out.

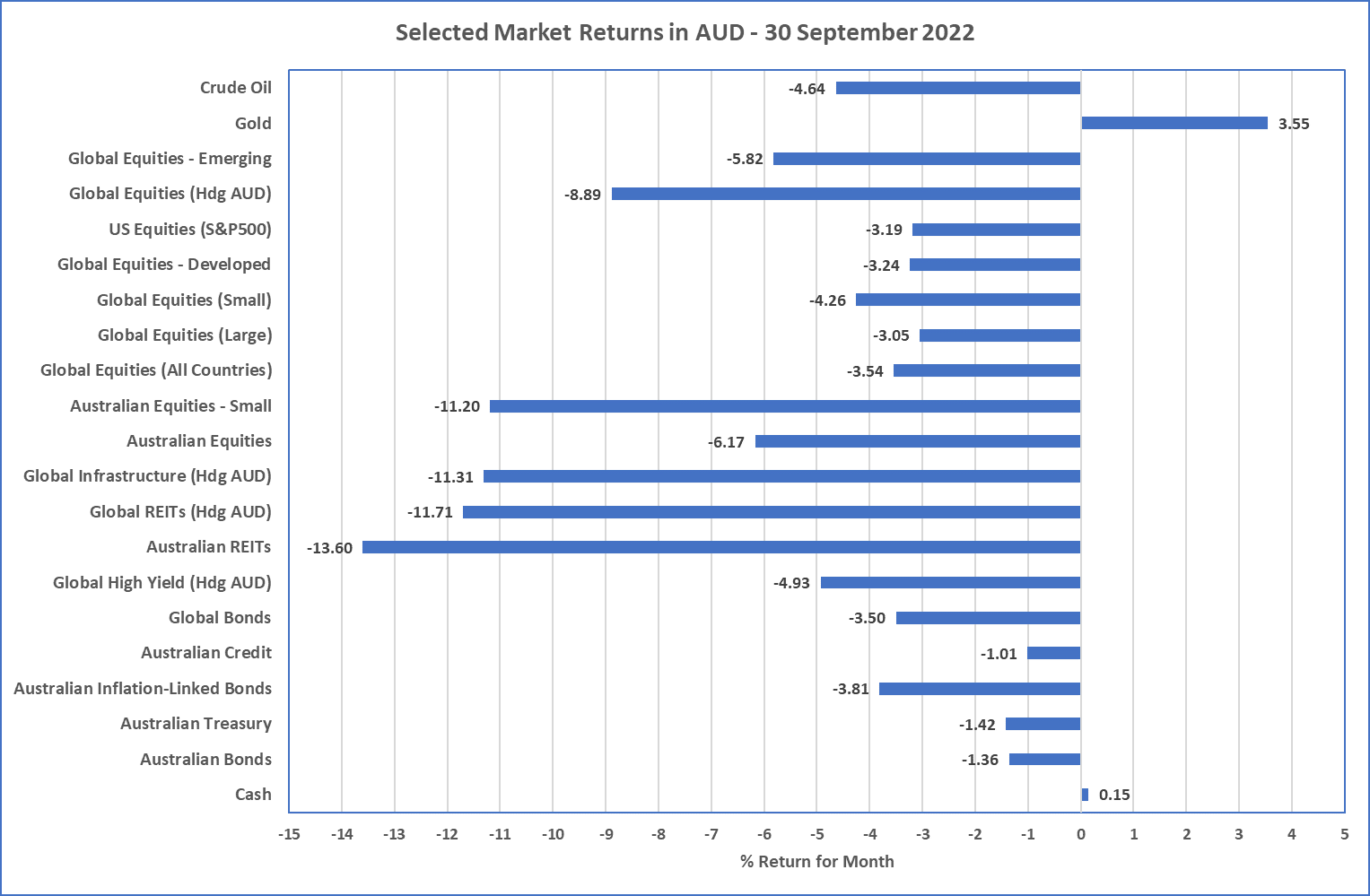

Chart 1: Hiding in Gold

What happened September?

Markets & Economy

Recession risks continue to increase as Central Banks continue to focus on inflation

- Chart 1 tells the story as the old generic safe haven asset, Gold, was the only major asset class that showed a reasonable positive return (3.55%) during September.

- With Central Banks around the world increasing interest rates and continuing to talk up rates and their focus on inflation, bond yields increased meaning prices decreased, equity markets sold off, and the sometimes inflation hedging real assets were the worst performers of all (down between 11% and 14% for September).

-

Whilst inflation is the concern of central banks there are some signs of moderation.

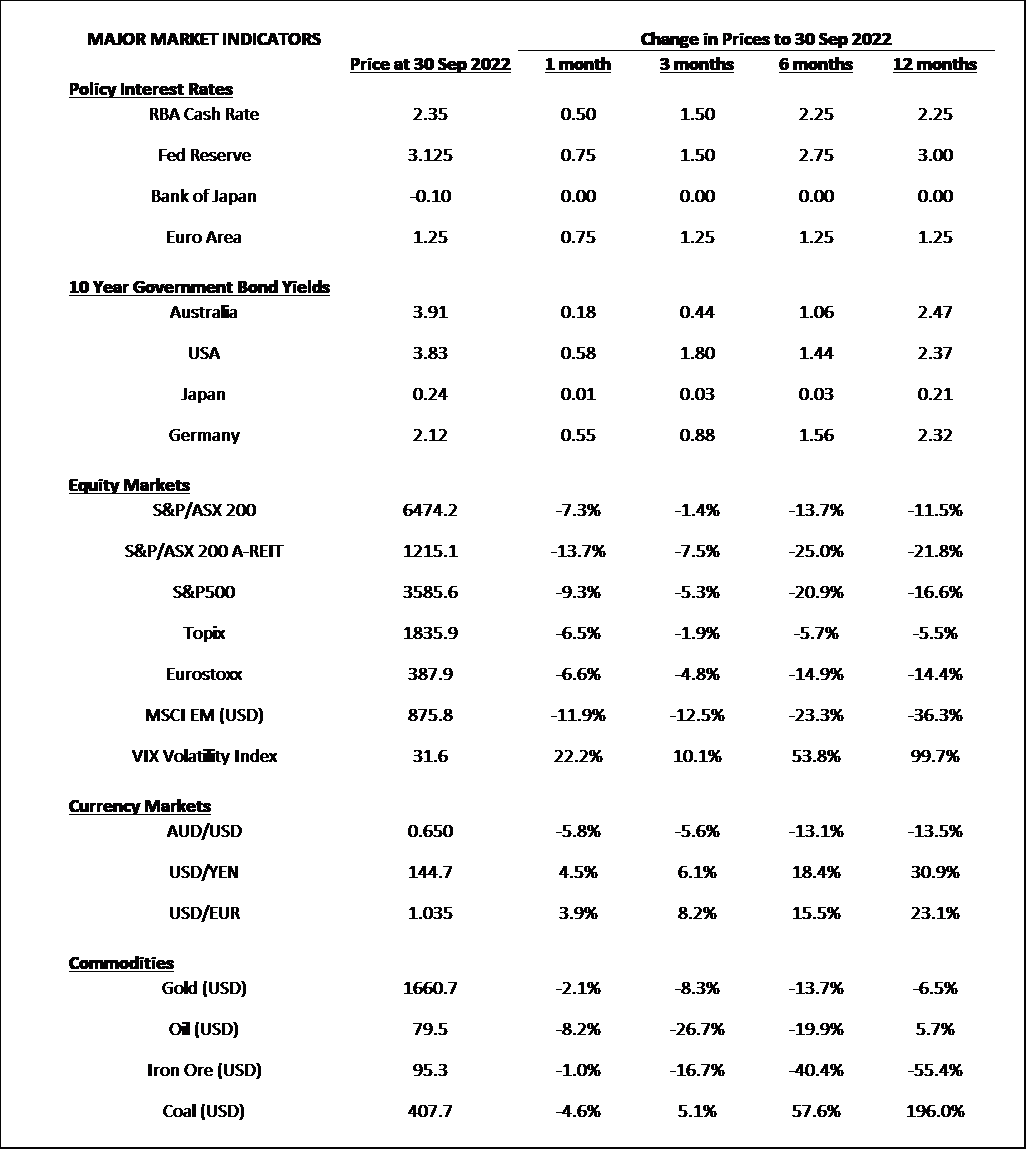

- At the end of September, many commodity prices are down including Oil where were 20% lower than 6 months prior. Other major commodities influential to inflation that are down significantly (10% or more) over the last three to six months include Copper, Iron Ore, Wheat, and Lumber.

- Lower levels of job openings and hires in US and slightly increasing job layoffs.

- Global money supply (M2) is down 5% year on year suggesting lower cash floating around the global economy.

- That said, there is strong belief that high inflation is likely to continue for some time yet as global supply problems, carried over from COVID, continue and the psychology of inflation means households buy today to avoid a price rise tomorrow.

- The current market sell-off has also favoured the US dollar, which is also seen as a safe haven, and at the end of September leaves the Australian dollar trading at $0.65USD. This has helped unhedged allocations to Global Equities, and this low level presents a long-term opportunity to consider shifting some global equities towards hedged positions, which may benefit from a rising Australian dollar.

Outlook

Whilst central banks are increasing cash rates, equities will be volatile

- It is a risk-off environment in global financial markets, and this is not likely to change in the short term.

- Increasing cash rates to combat inflation is at the cost of the economy as rising debt costs decrease purchasing power. Increasing global recession risks will continue.

- Valuations risks continue to be greatest in US Equities and this is our continued preferred underweight equities market. That said, it will be challenging for all equity markets in the short-term, so the current portfolio preference is for an underweight allocation to equities or preference to using conservative equity strategies (e.g. low volatility).

- Whilst bonds have also had a tough month, they are priced for positive real returns over the long run and greater recession risks mean there is a preference for higher quality investment grade bonds for now. As recession risks increase further longer-term bonds usually tend to perform well and the current yields of around 4% for 10-year bonds are a much better place to cater for recession than the 1.5% from a year ago.

- What is most important for all portfolios today is to diversify across asset class and securities with a focus on the long term. Whilst it’s a challenging time over the short term, current valuations across all major asset classes suggest a balanced portfolio is still likely to return more than 7%pa over the next 10 years.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619