Xerocon 2025 Recap

Ever wondered where the brightest minds in cloud accounting gather to swap ideas, get inspired and see what's new in the accounting world?

That's Xerocon - a high energy event that's as much about community as it is about cutting-edge tech.

For accountants, it's the perfect place to catch the latest trends, connect with industry leaders and bring back fresh ideas to the team.

This year, the event kicked off with an electrifying performance by the band Dragon, setting the tone for two days of energy and excitement.

The music had attendees on their feet, creating an atmosphere of celebration before diving into the sessions ahead.

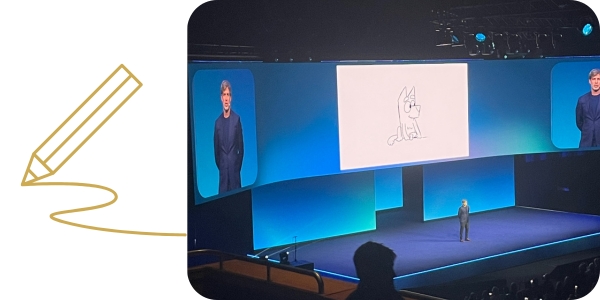

The stages of Xerocon were graced with guest speakers Joe Brumm, the Creator of Bluey, comedian Melanie Bracewell and a variety of

keynote speakers and Xero leaders in their fields presenting on a range of insightful topics.

For our team, Xerocon isn't just another conference - it's where big ideas meet real-world solutions. This year's Xerocon was no exception, with each team member taking away something different. Below are some of their key takeaways:

Director, Petrina:

"Community, Connection and Peer Learning matter more than ever - Not just about the product, Xerocon had numerous opportunities to share real-world experiences and connect with others in the industry. This is invaluable for all business owners to see what others are trying, borrow ideas, try them out, and adapt to fit your business."

"Resilience through Clarity and Proactivity - There is much economic uncertainty in the world, but the more you can do to have clear financial visibility and support the better. Using automation where possible and building resilience will help businesses be strong and free up time to focus on customers and relationships, where the human touch makes the biggest difference."

Senior Business & Tax Specialist Bhumika:

"How tools like Xero are helping us move beyond just doing the books - With smart features like automation and AI, we can save time and focus more on helping clients grow their businesses. It’s about working smarter, not harder. It was inspiring to see how purpose-led innovation is shaping the future of accounting."

"Sense of community - Despite being able to experience Xerocon online people still showed up. It was a great reminder that strong relationships with other advisors and the Xero Team is what really drives success in this profession. I had so much fun getting out of my comfort zone and meeting industry peers."

Graduate Business & Tax Advisor Ben:

"Diverse range of guest speakers who shared personal stories of resilience, innovation, and growth - These narratives not only inspired but also highlighted the importance of human connection in business and the value of learning from others' journeys. The event also highlighted how Xero and its ecosystem of integrated apps are transforming small business operations. From automating workflows to generating real-time financial insights, the use of AI and smart integrations is making business management more efficient and client-friendly."

"An immersive experience - I learnt how powerful AI can be when harnessed correctly, especially in small businesses. How it can automate routine tasks, generate meaningful financial data, and offer insights that help drive smarter decisions. The interactive stations and fun activities like pickleball added a vibrant energy to the event, making learning engaging and collaborative."

At McConachie Stedman, we're big on knowledge. In fact, it's one of our firm values. By offering our team these experiences, we hope to keep

raising the bar for our clients and our team.

General Advice Warning

The information provided in this article is for general information purposes only and is not intended to and does not constitute formal

taxation, financial or accounting advice. McConachie Stedman does not give any guarantee, warranty or make any representation that the

information is fit for a particular purpose. As such, you should not make any investment or other financial decision in reliance upon the

information set out in this correspondence and should seek professional advice on the financial, legal and taxation implications before

making any such decisions.